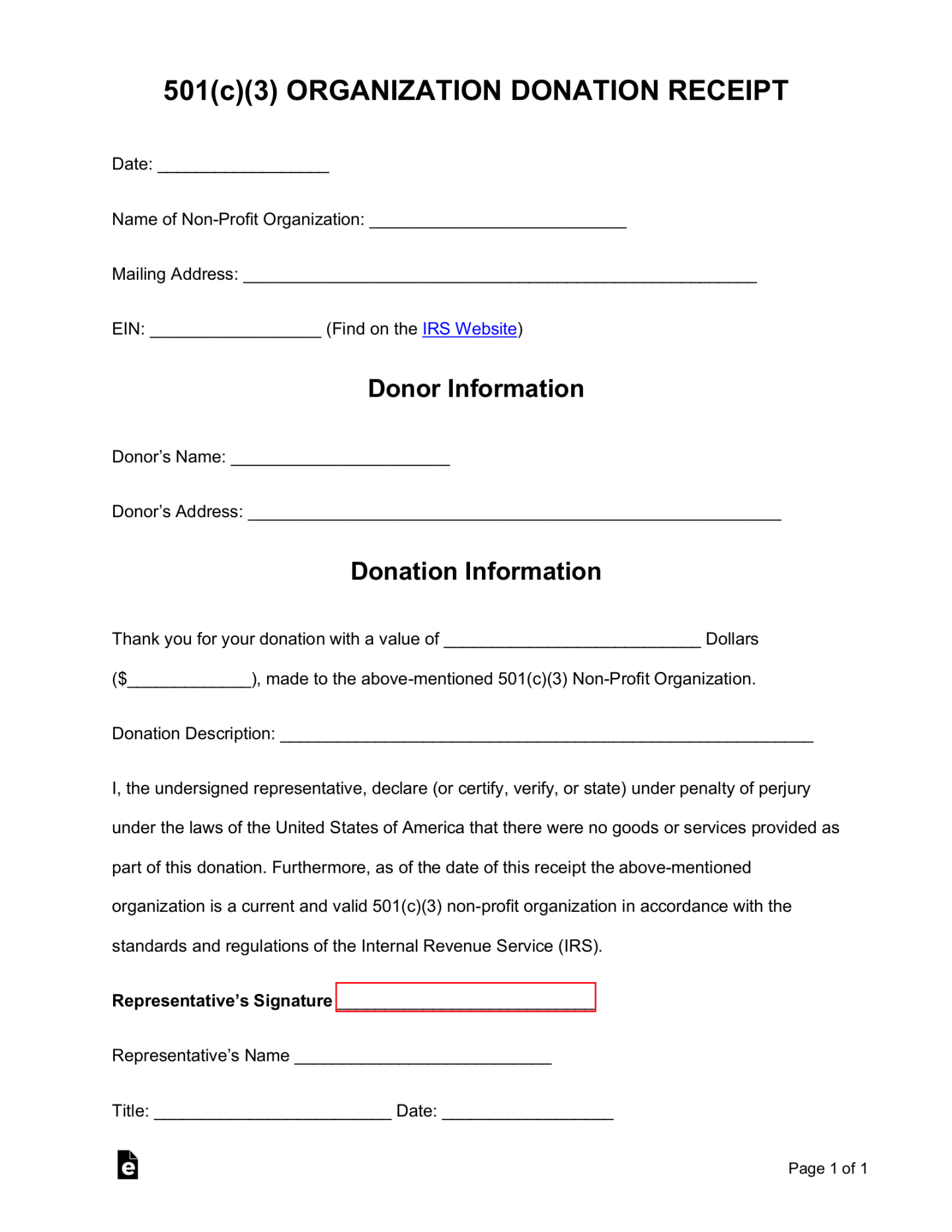

A tax donation receipt is a crucial document that provides donors with proof of their charitable contributions. This proof allows them to claim deductions on their income taxes, incentivizing giving and supporting nonprofit organizations. To ensure the receipt is both legally compliant and professionally presented, it’s essential to design a template that conveys trust, professionalism, and clarity.

Essential Elements of a Tax Donation Receipt

1. Donor Information: The receipt must clearly identify the donor. This includes their full name, address, and contact information.

2. Organization Information: The nonprofit organization’s name, address, and tax-exempt status (e.g., 501(c)(3)) should be prominently displayed.

3. Donation Amount: The exact amount of the donation, both in numerical and written form, is essential.

4. Date of Donation: The specific date the donation was received should be clearly stated.

5. Description of Donation: If the donation was a monetary gift, simply state “monetary donation.” For in-kind donations (e.g., goods, services), provide a detailed description of the item or service donated.

6. Acknowledgment Statement: A statement acknowledging the donor’s generosity and expressing gratitude is a courteous touch.

7. Receipt Number: Assigning a unique receipt number helps track donations and provides a reference point for the donor.

Design Considerations for Professionalism and Trust

1. Layout and Formatting: A clean and uncluttered layout enhances readability. Use a consistent font and font size throughout the template. Consider using a professional typeface that conveys reliability, such as Times New Roman or Arial.

2. Logo Placement: The nonprofit organization’s logo should be prominently displayed at the top of the receipt. Ensure it’s high-quality and visually appealing.

3. Heading and Subheadings: Use clear and concise headings and subheadings to organize the information and guide the donor’s eye.

4. White Space: Adequate white space between elements creates a visually pleasing and easy-to-read document. Avoid overcrowding the receipt with too much information.

5. Alignment: Align all text elements consistently, either left-aligned, right-aligned, or centered. Consistent alignment improves readability and professionalism.

6. Color Scheme: Choose a color scheme that reflects your organization’s brand and evokes trust. Avoid bright or flashy colors that might appear unprofessional.

7. Paper Quality: Use high-quality paper to create a lasting impression. Consider using letterhead or a slightly heavier paper weight for a more substantial feel.

Enhancing Donor Experience

1. Personalization: Include the donor’s name and the date of the donation at the top of the receipt to personalize the document.

2. Thank You Message: A handwritten or personalized thank you message can go a long way in fostering donor loyalty.

3. Additional Information: If relevant, consider including information about how the donation will be used or the impact it will have.

By carefully designing a tax donation receipt template that incorporates these elements and design considerations, you can create a document that is both professional and meaningful to your donors. A well-crafted receipt not only fulfills legal requirements but also strengthens your organization’s reputation and encourages continued support.

![[Real & Fake] Hotel Receipt Templates ᐅ TemplateLab](https://ashfordhousewicklow.com/wp-content/uploads/2024/09/real-amp-fake-hotel-receipt-templates-templatelab_0-200x135.jpg)