Risk management agreements are essential legal documents that outline the responsibilities, obligations, and strategies for managing potential risks in various business ventures. A well-crafted template can serve as a valuable tool for mitigating risks, ensuring transparency, and fostering trust among parties involved.

Key Components of a Risk Management Agreement Template

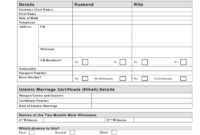

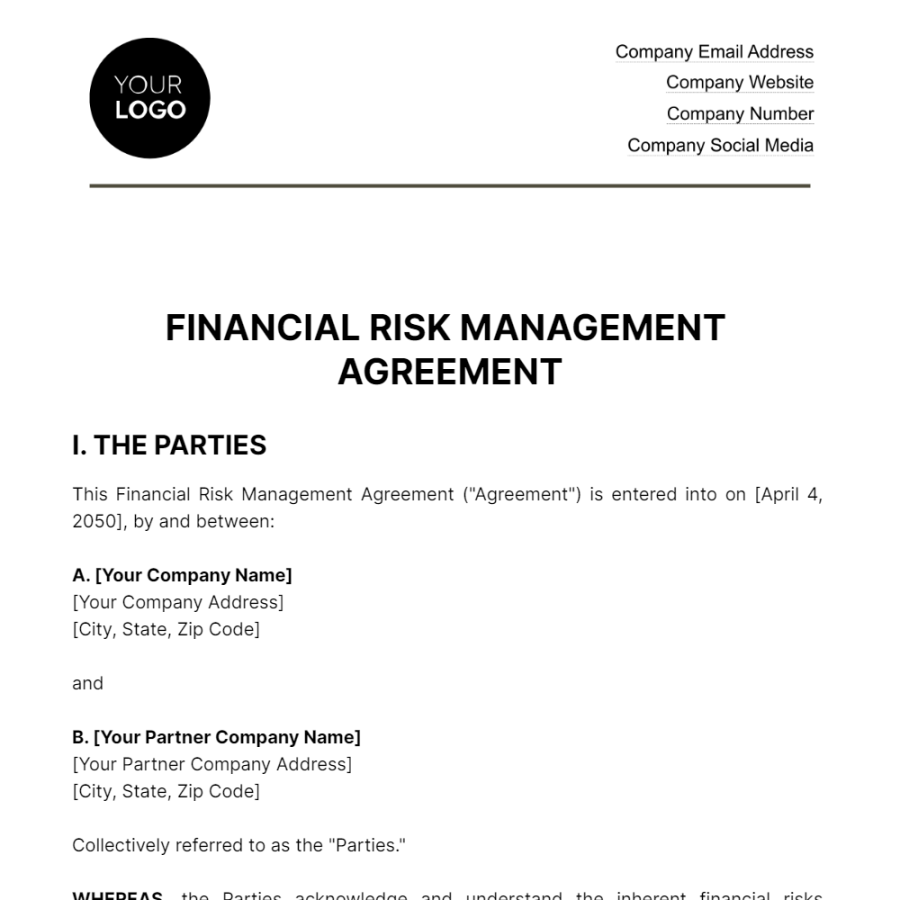

1. Parties Involved: Clearly identify all parties involved in the agreement, including their legal names and addresses. This section should establish the contractual relationship between the parties.

2. Scope of the Agreement: Define the specific scope of the agreement, outlining the activities, projects, or ventures covered by the risk management plan. This will help ensure that the agreement is tailored to the specific circumstances of the project.

3. Risk Identification: Conduct a thorough risk assessment to identify all potential risks that could impact the project. This may include operational risks, financial risks, legal risks, and reputational risks.

4. Risk Assessment and Evaluation: Analyze each identified risk to determine its potential impact and likelihood of occurrence. This information will help prioritize risks and allocate resources accordingly.

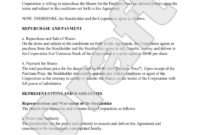

5. Risk Mitigation Strategies: Outline the strategies and measures that will be implemented to mitigate or eliminate identified risks. These may include risk avoidance, risk transfer, risk reduction, or risk acceptance.

6. Risk Monitoring and Reporting: Establish a process for ongoing monitoring and reporting of risks throughout the project’s lifecycle. This will enable early detection of emerging risks and prompt implementation of corrective actions.

7. Contingency Planning: Develop contingency plans to address potential risks that may materialize despite mitigation efforts. These plans should outline specific actions to be taken in the event of a risk occurrence.

8. Communication and Coordination: Define the communication channels and processes for ensuring effective communication and coordination among all parties involved in the risk management process.

9. Dispute Resolution: Establish a mechanism for resolving disputes that may arise related to the risk management agreement. This may include negotiation, mediation, or arbitration.

10. Term and Termination: Specify the duration of the agreement and the conditions under which it may be terminated. This section should also address the consequences of early termination and any obligations that may survive termination.

Design Elements for a Professional Risk Management Agreement Template

To create a risk management agreement template that conveys professionalism and trust, consider the following design elements:

Clear and Concise Language: Use plain language that is easy to understand for all parties involved. Avoid legal jargon that may be confusing or ambiguous.

By carefully considering these key components and design elements, you can create a risk management agreement template that effectively protects your interests and fosters trust among all parties involved.