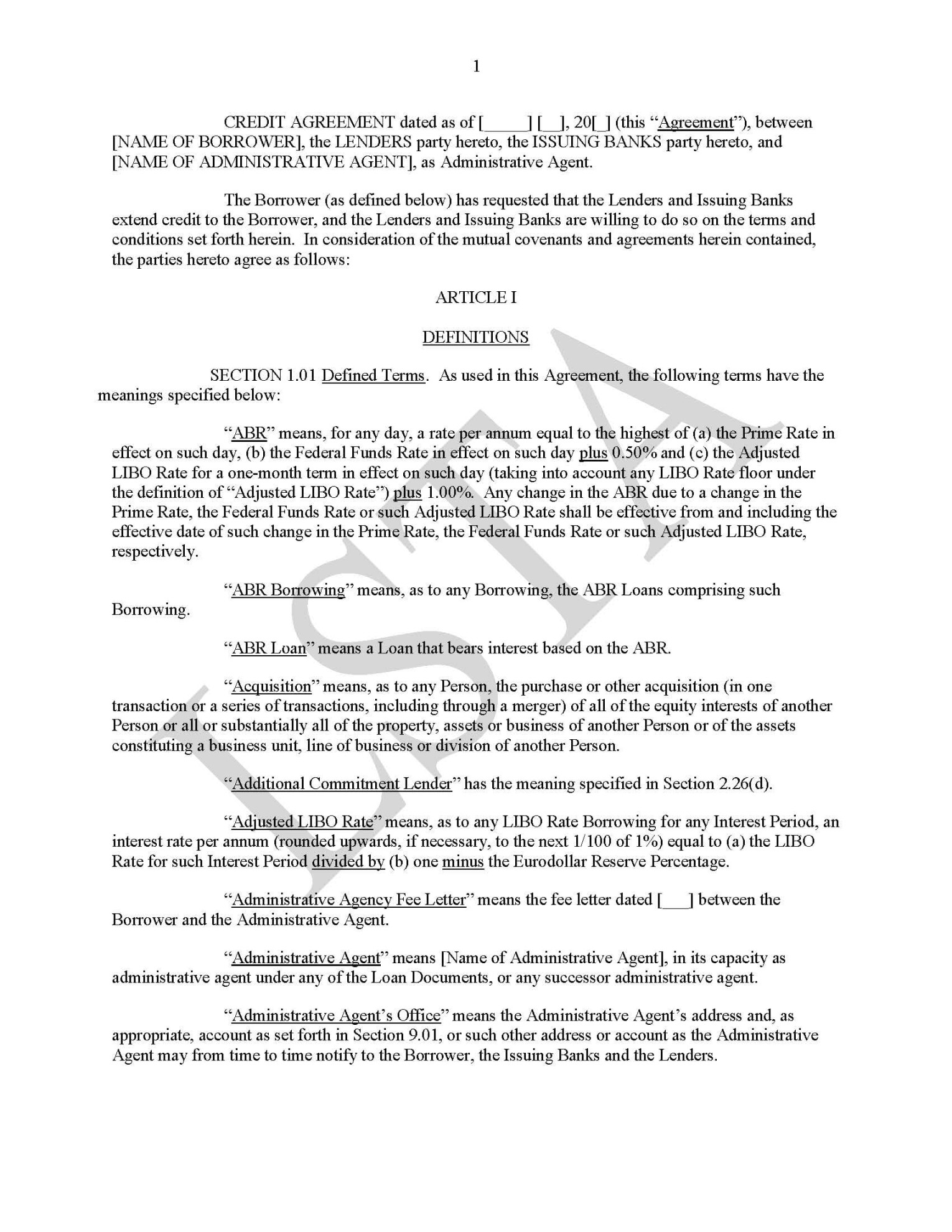

A revolving credit facility agreement is a legal document that outlines the terms and conditions under which a lender agrees to provide a line of credit to a borrower. This type of credit facility allows the borrower to access funds as needed, up to a pre-determined limit, and repay the outstanding balance over time.

Key Components of a Revolving Credit Facility Agreement

A well-structured revolving credit facility agreement should include the following essential components:

Parties

Borrower: The entity receiving the credit facility.

Credit Limit

Interest Rate

Base Rate: The benchmark interest rate used to calculate the interest charged on the outstanding balance.

Repayment Terms

Minimum Periodic Payment: The minimum amount the borrower must repay each period.

Drawdowns and Repayments

Drawdown Procedures: The process for the borrower to access funds from the credit facility.

Collateral

Security Interest: The lender’s interest in specific assets of the borrower to secure the loan.

Covenants

Financial Covenants: Requirements related to the borrower’s financial performance, such as debt-to-equity ratio or interest coverage ratio.

Events of Default

Triggering Events: Circumstances that constitute a default under the agreement, such as non-payment or breach of covenants.

Governing Law and Dispute Resolution

Applicable Law: The jurisdiction that governs the agreement.

Design Elements for a Professional Template

To create a revolving credit facility agreement template that conveys professionalism and trust, consider the following design elements:

Clear and Concise Language: Use simple, straightforward language that is easy to understand. Avoid legal jargon whenever possible.

By incorporating these design elements, you can create a revolving credit facility agreement template that is not only informative but also visually appealing and professional.