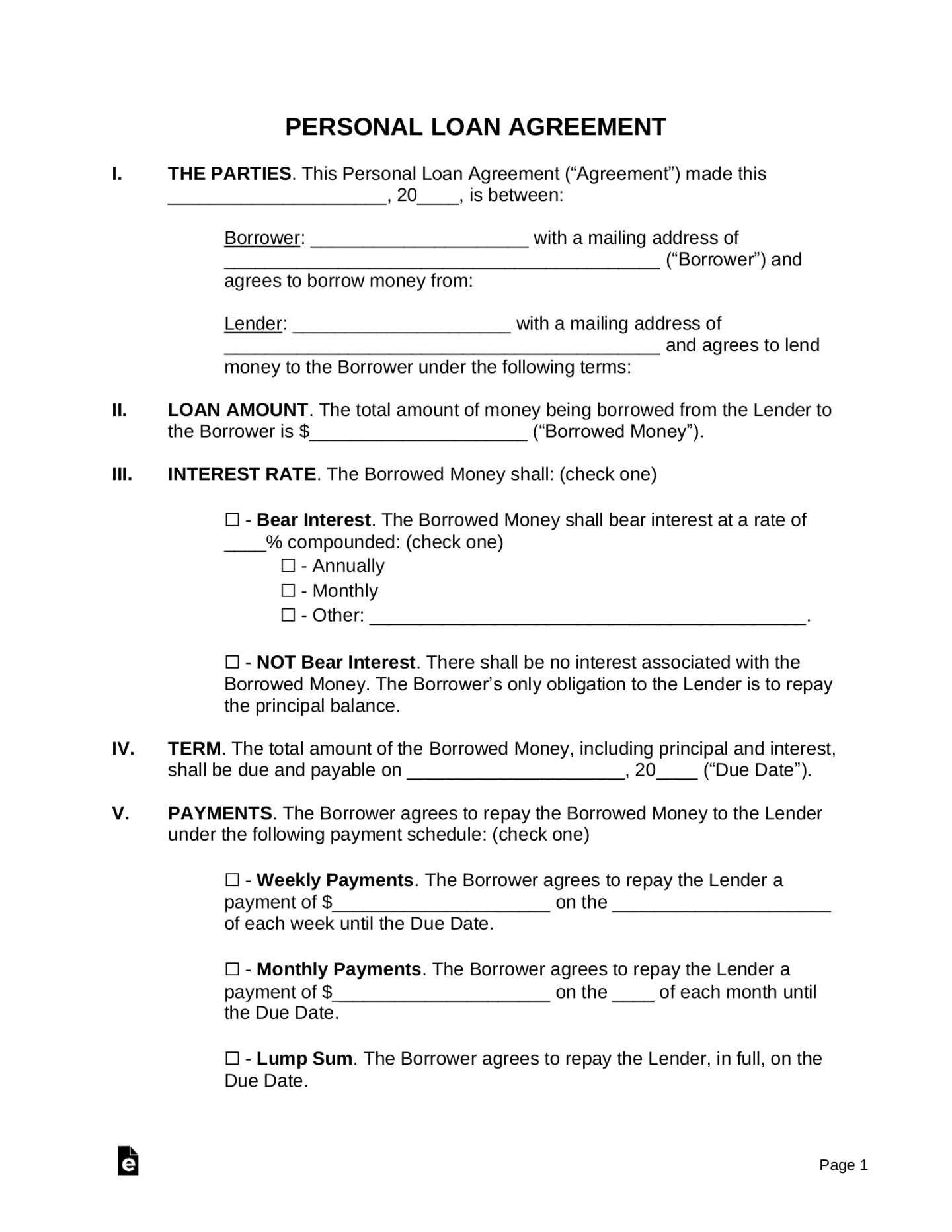

A private loan agreement template is a legal document that outlines the terms and conditions of a loan between two parties. It serves as a contract that protects the interests of both the lender and the borrower. While there are many online resources available to create a basic template, crafting a truly professional document requires careful attention to detail and adherence to legal standards.

Essential Elements of a Private Loan Agreement

A well-structured private loan agreement should include the following key elements:

Parties Involved

Lender: The individual or entity providing the loan.

Loan Amount and Terms

Principal Amount: The total amount of the loan.

Collateral (Optional)

Description of Collateral: If applicable, a detailed description of any assets pledged as security.

Default Provisions

Events of Default: Circumstances that trigger a default, such as late payments or breach of contract.

Governing Law and Dispute Resolution

Governing Law: The jurisdiction that governs the agreement.

Other Provisions

Prepayment: The borrower’s right to repay the loan early, and any associated penalties.

Design Elements for a Professional Template

To create a private loan agreement template that conveys professionalism and trust, consider the following design elements:

Clear and Concise Language

Use plain language that is easy to understand.

Consistent Formatting

Use a consistent font, font size, and line spacing throughout the document.

Professional Layout

Use a clean and uncluttered layout.

Legal Disclaimer

Include a disclaimer stating that the template is a general guide and does not constitute legal advice.

Additional Tips for Creating a Professional Template

Tailor the template to your specific needs. Consider the unique circumstances of your loan and customize the agreement accordingly.

By following these guidelines and incorporating the essential elements of a private loan agreement, you can create a professional and legally sound document that protects the interests of both the lender and the borrower.