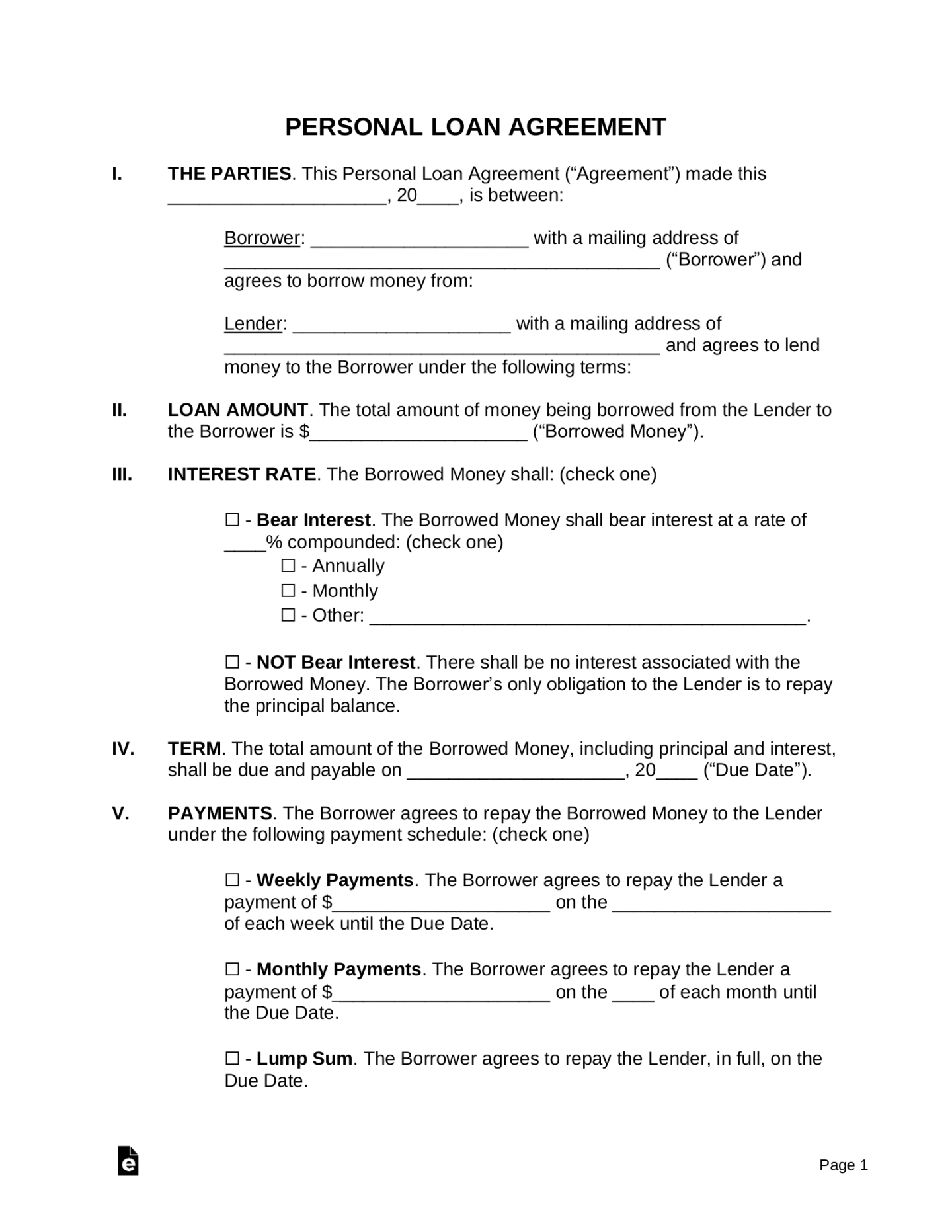

A personal loan repayment agreement template is a legal document that outlines the terms and conditions of a personal loan between a lender and a borrower. It serves as a contract that protects the interests of both parties involved. When creating a professional personal loan repayment agreement template, it is essential to consider several key elements that convey professionalism and trust.

Essential Components of a Personal Loan Repayment Agreement Template

1. Loan Amount and Terms: Clearly specify the total loan amount, interest rate, and repayment schedule. Include the frequency of payments (e.g., monthly, weekly) and the duration of the loan term.

2. Repayment Schedule: Outline the exact dates and amounts of each payment. Consider using a payment schedule table for clarity and organization.

3. Late Payment Penalties: Define the consequences of late payments, such as late fees or interest accrual on the outstanding balance.

4. Prepayment Penalties: If applicable, specify any penalties for early repayment of the loan.

5. Default Provisions: Clearly state the actions that will be taken in the event of default, such as acceleration of the loan balance, legal action, or repossession of collateral (if applicable).

6. Governing Law: Indicate the jurisdiction that will govern the agreement in case of disputes.

7. Entire Agreement Clause: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

8. Severability Clause: Specify that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

9. Dispute Resolution: Outline the procedure for resolving disputes, such as mediation or arbitration.

10. Signatures: Include a section for both the lender and borrower to sign the agreement, along with their printed names and dates.

Design Elements for a Professional Personal Loan Repayment Agreement Template

1. Clear and Concise Language: Use simple, straightforward language that is easy to understand. Avoid legal jargon or technical terms that may confuse the parties.

2. Consistent Formatting: Maintain consistent formatting throughout the document, including font size, font style, and spacing. Use headings and subheadings to organize the content.

3. Professional Layout: Choose a clean and professional layout that is visually appealing and easy to read. Consider using a template or design software to create a polished look.

4. White Space: Use white space effectively to improve readability and create a sense of balance. Avoid overcrowding the page with text.

5. Branding: If applicable, incorporate your branding elements into the template, such as your company logo or color scheme. This can help establish trust and credibility.

Additional Considerations

1. Customization: Tailor the template to the specific needs of the loan. Consider factors such as the loan amount, interest rate, repayment schedule, and collateral requirements.

2. Legal Review: Consult with an attorney to ensure that the template complies with applicable laws and regulations.

3. Electronic Signatures: If desired, use electronic signatures to streamline the process and reduce the need for physical copies.

By following these guidelines and incorporating the essential components and design elements, you can create a professional personal loan repayment agreement template that effectively protects the interests of both the lender and the borrower.