A payroll confidentiality agreement is a legally binding document that outlines the specific obligations of an individual or entity to keep confidential any sensitive information related to payroll processing. This agreement is crucial for safeguarding the privacy of employees and protecting the financial interests of an organization.

Key Components of a Payroll Confidentiality Agreement

To ensure a comprehensive and legally sound agreement, the following elements should be included:

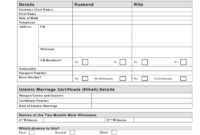

1. Parties to the Agreement

Clearly identify the parties involved in the agreement. This typically includes the employer and the employee or contractor.

2. Definitions

Provide precise definitions of key terms used in the agreement, such as “Confidential Information,” “Payroll Data,” and “Material Breach.”

3. Scope of Confidentiality

Specify the types of information that are considered confidential. This may include employee names, addresses, Social Security numbers, wages, hours worked, benefits, and any other sensitive payroll data.

4. Obligations of the Parties

Outline the specific obligations of each party to maintain confidentiality. This typically includes:

Employee Obligations:

5. Permitted Disclosures

Identify any circumstances under which the parties may disclose Confidential Information without violating the agreement. This may include:

Legal Requirements: Disclosure is required by law, regulation, or court order.

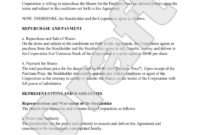

6. Term and Termination

Specify the duration of the agreement and the conditions under which it may be terminated. Consider including provisions for automatic renewal or termination upon a material breach.

7. Remedies for Breach

Outline the remedies available to the non-breaching party in the event of a breach of the agreement. This may include injunctive relief, damages, and attorney’s fees.

8. Governing Law and Jurisdiction

Indicate the governing law that will apply to the agreement and the jurisdiction in which any disputes will be resolved.

Design Considerations for a Professional Payroll Confidentiality Agreement

To convey professionalism and trust, consider the following design elements:

Clear and Concise Language: Use plain language that is easy to understand. Avoid legal jargon or technical terms that may confuse the parties.

By carefully considering these elements, you can create a payroll confidentiality agreement that is both legally sound and visually appealing. This will help to protect your organization’s sensitive payroll data and foster trust with your employees and contractors.