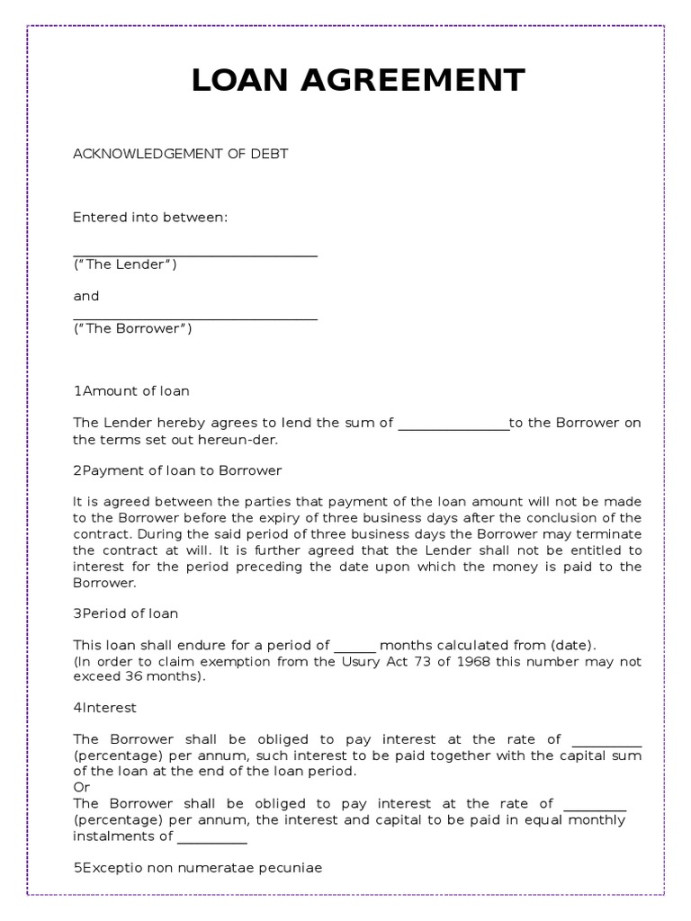

A non-recourse loan agreement is a legal document that outlines the terms and conditions of a loan where the lender is only entitled to recover the loan amount from the specific collateral pledged by the borrower. In contrast to a recourse loan, where the lender can pursue the borrower’s personal assets if the loan is not repaid, a non-recourse loan limits the lender’s risk to the value of the collateral.

Essential Elements of a Non-Recourse Loan Agreement

A well-structured non-recourse loan agreement should include the following essential elements:

Parties Involved

Lender: The party providing the loan.

Loan Amount and Terms

Principal Amount: The total amount of the loan.

Collateral

Description of Collateral: A detailed description of the assets being pledged as collateral.

Default and Remedies

Default Events: Circumstances that constitute a default on the loan, such as missed payments or breach of contract.

Governing Law and Dispute Resolution

Governing Law: The jurisdiction that will govern the terms of the agreement.

Other Provisions

Prepayment: The terms for prepaying the loan before the maturity date.

Designing a Professional Template

To create a professional non-recourse loan agreement template, consider the following design elements:

Clear and Concise Language: Use plain language that is easy to understand. Avoid legal jargon that may confuse the parties.

Additional Tips for Creating a Professional Template

Use a Template Software: Consider using a template software or online platform to streamline the process of creating the agreement.

By following these guidelines and incorporating the essential elements of a non-recourse loan agreement, you can create a professional template that effectively protects the interests of both the lender and the borrower.