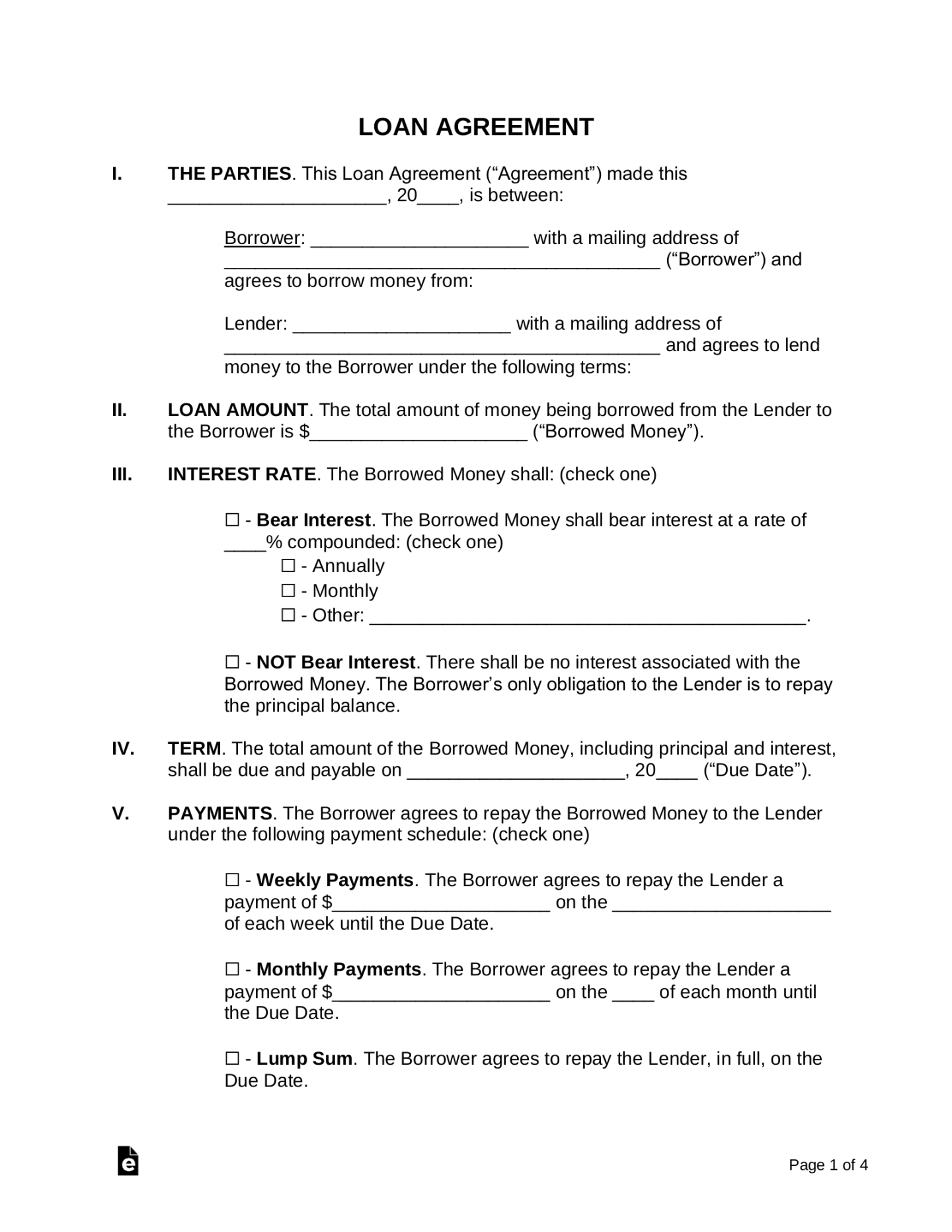

A long-term loan agreement template is a legal document that outlines the terms and conditions of a loan between a lender and a borrower for a significant period. It provides a structured framework for both parties to understand their rights and obligations, ensuring a transparent and legally binding arrangement.

Essential Elements of a Long-Term Loan Agreement Template

1. Parties Involved: Clearly identify the lender and borrower by their full legal names and addresses.

2. Loan Amount and Terms: Specify the total amount of the loan, the interest rate to be charged, and the repayment schedule, including the frequency and due dates of installments.

3. Collateral (if applicable): If the loan is secured by collateral, describe the specific assets being used as collateral and the procedures for their valuation and sale in case of default.

4. Prepayment Clause: Outline the borrower’s right to prepay the loan and any associated fees or penalties.

5. Default Provisions: Define the events that constitute a default, such as late payments, non-payment, or breach of other terms. Specify the remedies available to the lender, including acceleration of the loan balance, foreclosure of collateral, and legal action.

6. Governing Law and Jurisdiction: Indicate the governing law that will apply to the agreement and the jurisdiction in which any disputes will be resolved.

7. Entire Agreement Clause: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

8. Severability Clause: Specify that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

9. Notices: Establish the procedures for giving notices between the parties, including the required method (e.g., written notice, email) and address.

10. Signatures: Ensure that both the lender and borrower sign the agreement, along with their printed names and dates.

Design Elements for Professionalism and Trust

Clear and Concise Language: Use plain language that is easy to understand, avoiding legal jargon whenever possible.

Additional Considerations

Customization: Tailor the template to the specific needs of the loan transaction, considering factors such as the loan amount, interest rate, repayment terms, and collateral.

By following these guidelines and incorporating the essential elements, you can create a professional long-term loan agreement template that effectively protects the interests of both the lender and borrower.