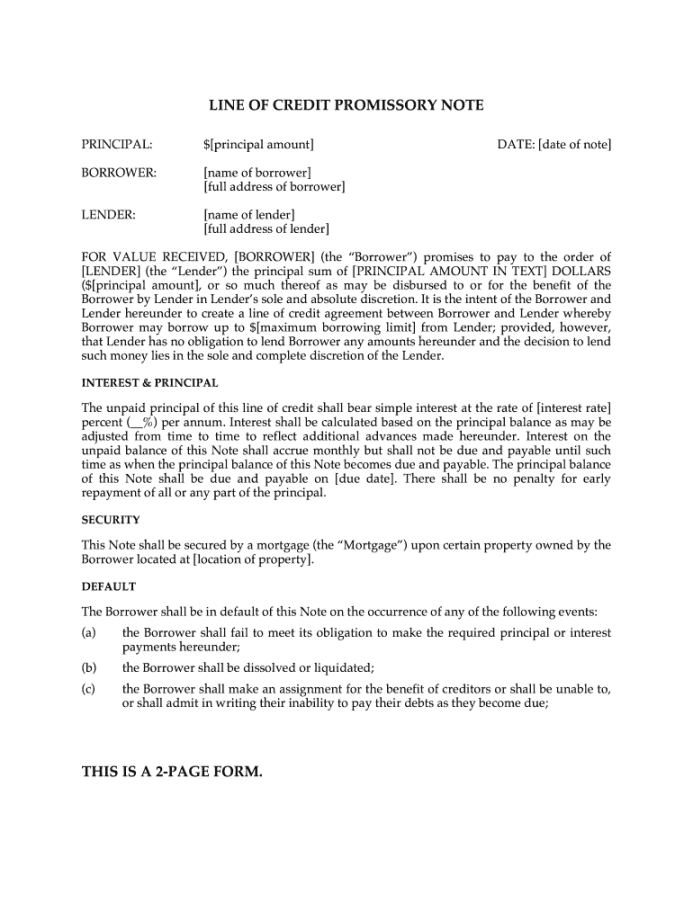

A line of credit loan agreement template is a crucial document that outlines the terms and conditions governing a line of credit loan between a lender and a borrower. This template serves as a legal contract, ensuring that both parties understand their rights and obligations. It is essential to create a professional and well-structured template that conveys trust and professionalism.

Key Components of a Line of Credit Loan Agreement Template

1. Parties Involved: Clearly identify the lender and the borrower. Include their full legal names and addresses.

2. Credit Limit: Specify the maximum amount that the borrower can borrow under the line of credit.

3. Interest Rate: Indicate the interest rate that will be applied to the outstanding balance. This may be a fixed rate or a variable rate.

4. Repayment Terms: Outline the repayment schedule, including the minimum monthly payment and any prepayment penalties.

5. Collateral: If applicable, specify any collateral that the borrower is providing to secure the loan.

6. Default: Define what constitutes a default event and the consequences of default, such as acceleration of the entire outstanding balance.

7. Governing Law: Specify the jurisdiction that will govern the agreement in case of a dispute.

8. Notices: Establish how notices will be given to the lender and the borrower.

9. Amendments: Outline the process for amending the agreement.

10. Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes any prior agreements or representations.

Design Elements for a Professional Line of Credit Loan Agreement Template

1. Clear and Concise Language: Use simple, straightforward language that is easy to understand. Avoid legal jargon that may confuse the borrower.

2. Consistent Formatting: Maintain consistent formatting throughout the document, using headings, subheadings, and bullet points to improve readability.

3. Professional Layout: Choose a professional font and font size that is easy to read. Use appropriate margins and line spacing to create a clean and organized layout.

4. Headings and Subheadings: Use clear and informative headings and subheadings to guide the reader through the document.

5. Tables and Lists: Use tables and lists to present information in a clear and organized manner.

6. White Space: Incorporate sufficient white space to make the document visually appealing and easy to read.

7. Branding: If applicable, include your company’s logo and branding elements to enhance professionalism.

Example of a Line of Credit Loan Agreement Template Section

Parties Involved

Lender: [Lender’s Name]

Credit Limit

The credit limit for this line of credit is [Credit Limit].

Interest Rate

The interest rate for this line of credit is [Interest Rate].

Repayment Terms

The borrower shall make minimum monthly payments of [Minimum Monthly Payment] on the outstanding balance. The interest rate will be applied to the daily average balance.

Collateral

The borrower shall provide [Collateral] as security for this loan.

Default

A default event shall occur if the borrower fails to make timely payments or breaches any other term of this agreement. In the event of a default, the lender may accelerate the entire outstanding balance.

Conclusion

A well-designed line of credit loan agreement template is essential for establishing a clear and legally binding contract between a lender and a borrower. By following the guidelines outlined in this guide, you can create a professional and informative template that fosters trust and protects the interests of both parties.