An investment receipt is a crucial document that serves as a formal record of a financial transaction involving the investment of funds. It provides essential details about the investment, such as the amount invested, the investor’s information, the investment type, and the terms and conditions. A well-designed investment receipt template can enhance the professionalism and credibility of your investment firm.

Key Elements of an Investment Receipt Template

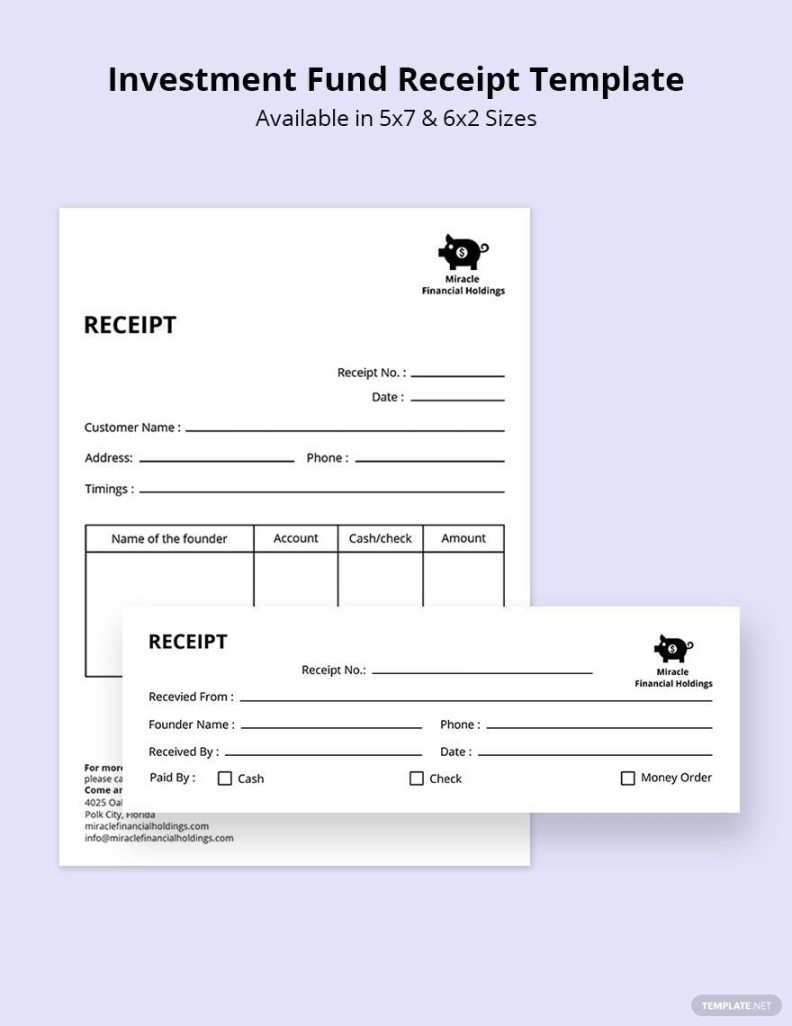

1. Header: The header should prominently display the name of your investment firm, its logo, and contact information. This establishes your brand identity and provides easy accessibility for investors.

2. Receipt Number: Assign a unique receipt number to each document for easy identification and tracking.

3. Date: Clearly indicate the date of the investment transaction.

4. Investor Information: Collect the investor’s full name, address, contact information, and tax identification number (if applicable). This ensures accurate record-keeping and compliance with regulatory requirements.

5. Investment Details: Specify the type of investment (e.g., stocks, bonds, mutual funds), the investment amount, and the currency used. Include any relevant investment terms, such as maturity date, interest rate, or dividend payout schedule.

6. Payment Information: Detail the payment method (e.g., cash, check, wire transfer) and the date of payment.

7. Terms and Conditions: Outline the terms and conditions associated with the investment, including fees, charges, and any risks involved. This provides transparency and protects both the investor and the investment firm.

8. Signature: Require the investor’s signature to acknowledge their agreement to the terms and conditions.

9. Investment Firm Representative: Include the signature of the investment firm representative handling the transaction, along with their name and position.

Design Considerations for a Professional Investment Receipt Template

1. Layout and Formatting: Opt for a clean and uncluttered layout that is easy to read and navigate. Use consistent fonts, font sizes, and spacing throughout the template.

2. Color Scheme: Choose a professional color scheme that reflects your brand identity and evokes trust. Avoid bright or overly flashy colors that can appear unprofessional.

3. Branding Elements: Incorporate your company logo, tagline, and other branding elements to reinforce your brand recognition.

4. Professional Language: Use clear and concise language that is easy to understand. Avoid jargon or technical terms that may confuse investors.

5. Alignment: Align all text elements consistently (e.g., left-aligned, right-aligned, centered) to create a visually appealing and organized template.

6. White Space: Use white space effectively to create a sense of balance and readability. Avoid overcrowding the template with too much information.

Additional Tips for Creating a Professional Investment Receipt Template

Use high-quality paper: A professional-looking investment receipt should be printed on high-quality paper to convey a sense of legitimacy.

By following these guidelines, you can create an investment receipt template that is both professional and informative, helping to build trust and credibility with your investors.

![[Real & Fake] Hotel Receipt Templates ᐅ TemplateLab](https://ashfordhousewicklow.com/wp-content/uploads/2024/09/real-amp-fake-hotel-receipt-templates-templatelab_0-200x135.jpg)