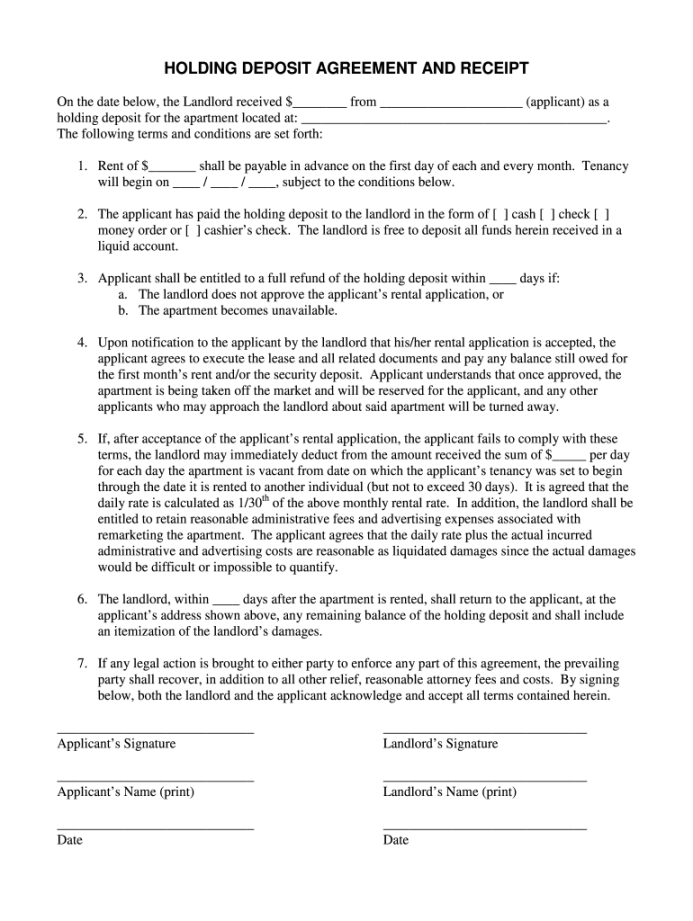

A holding deposit agreement is a legal document that binds a potential tenant to a property rental agreement. It’s typically a small sum of money that serves as a commitment from the tenant to lease the property. For landlords, it’s a way to secure a tenant and prevent the property from remaining vacant.

Designing the Template for Professionalism and Trust

1. Clear and Concise Language: The language used in the agreement should be straightforward and easy to understand. Avoid legal jargon that might confuse the tenant.

2. Consistent Formatting: Maintain consistency throughout the document. Use a clean and readable font, such as Arial or Times New Roman. Ensure the margins are balanced, and the text is justified for a professional appearance.

3. Heading and Subheadings: Use clear and descriptive headings and subheadings to organize the content and make it easier to navigate.

4. Whitespace: Incorporate ample whitespace to improve readability. Avoid overcrowding the page with text.

5. Professional Layout: Choose a layout that is visually appealing and professional. Consider using a table of contents or a sidebar to help organize the information.

6. Branding Elements: If applicable, include your branding elements, such as your logo, company name, and contact information. This can help establish trust and credibility.

Key Sections of a Holding Deposit Agreement Template

1. Parties Involved: Clearly identify the parties involved in the agreement, including the landlord’s name and contact information, and the tenant’s name and contact information.

2. Property Description: Provide a detailed description of the property, including the address, rental period, and monthly rent.

3. Holding Deposit Amount: Specify the amount of the holding deposit and the due date.

4. Terms and Conditions: Outline the terms and conditions of the agreement, including:

5. Signatures: Ensure that both the landlord and the tenant sign the agreement. Include a space for witnesses to sign as well.

Additional Considerations

Legal Review: It’s recommended to have a legal professional review the agreement to ensure it complies with local laws and regulations.

By following these guidelines and carefully crafting your holding deposit agreement template, you can create a professional and legally sound document that protects your interests as a landlord while providing clarity and transparency to potential tenants.