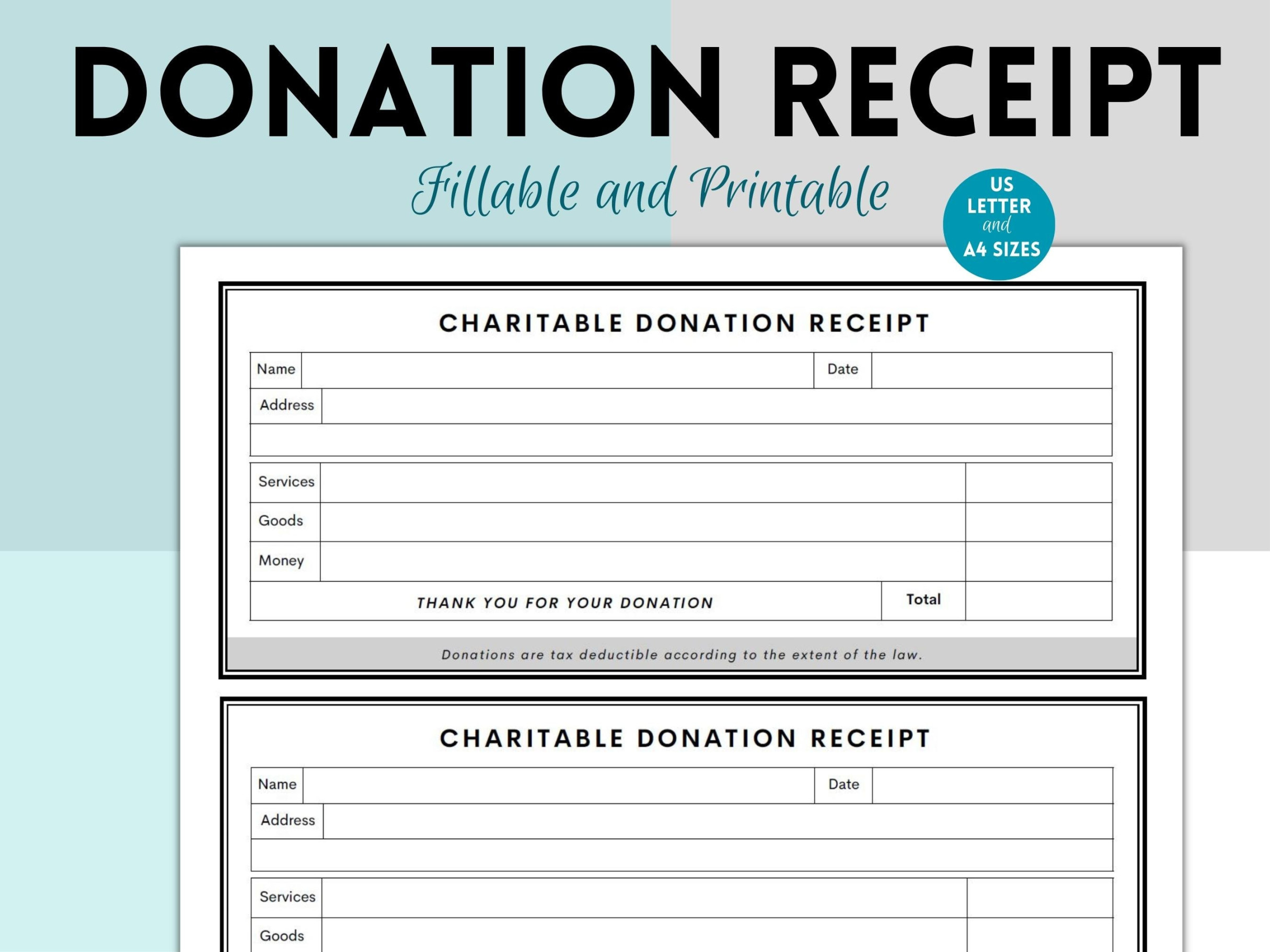

A Gift In Kind receipt Template serves as a formal acknowledgment of non-monetary donations received by an organization. This document is crucial for maintaining accurate records, ensuring tax compliance, and fostering donor relationships. To create a professional Gift In Kind Receipt Template, consider the following essential elements:

Header

Organization Name: Place the organization’s name prominently at the top of the template, often in a larger font size or bold typeface.

Recipient Information

Donor Name: Clearly indicate the name of the individual or organization that donated the gift in kind.

Gift Description

Itemized List: Provide a detailed description of each item donated, including quantity, condition, and estimated fair market value.

Fair Market Value

Valuation Method: Indicate the method used to determine the fair market value of the donated items. This might include appraisals, online market research, or consultation with experts.

Tax Deductibility

Deductibility Statement: Provide a statement informing the donor whether the donation is tax-deductible. Refer to relevant tax laws and regulations for specific guidance.

Acknowledgment

Gratitude Statement: Express sincere gratitude to the donor for their generous contribution.

Authorized Signature

Signature Line: Provide a space for an authorized representative of the organization to sign the receipt.

Design Considerations

Layout: Choose a clean and uncluttered layout that is easy to read and visually appealing.

By carefully designing and implementing these elements, you can create a professional Gift In Kind Receipt Template that effectively acknowledges donations, maintains accurate records, and strengthens relationships with donors.

![[Real & Fake] Hotel Receipt Templates ᐅ TemplateLab](https://ashfordhousewicklow.com/wp-content/uploads/2024/09/real-amp-fake-hotel-receipt-templates-templatelab_0-200x135.jpg)