A free installment loan agreement template is a valuable tool for individuals and businesses involved in loan transactions. By providing a structured framework, these templates help ensure that all parties involved understand the terms and conditions of the loan clearly. This guide will delve into the essential elements of a professional free installment loan agreement template, focusing on design elements that convey professionalism and trust.

Essential Elements of a Free Installment Loan Agreement Template

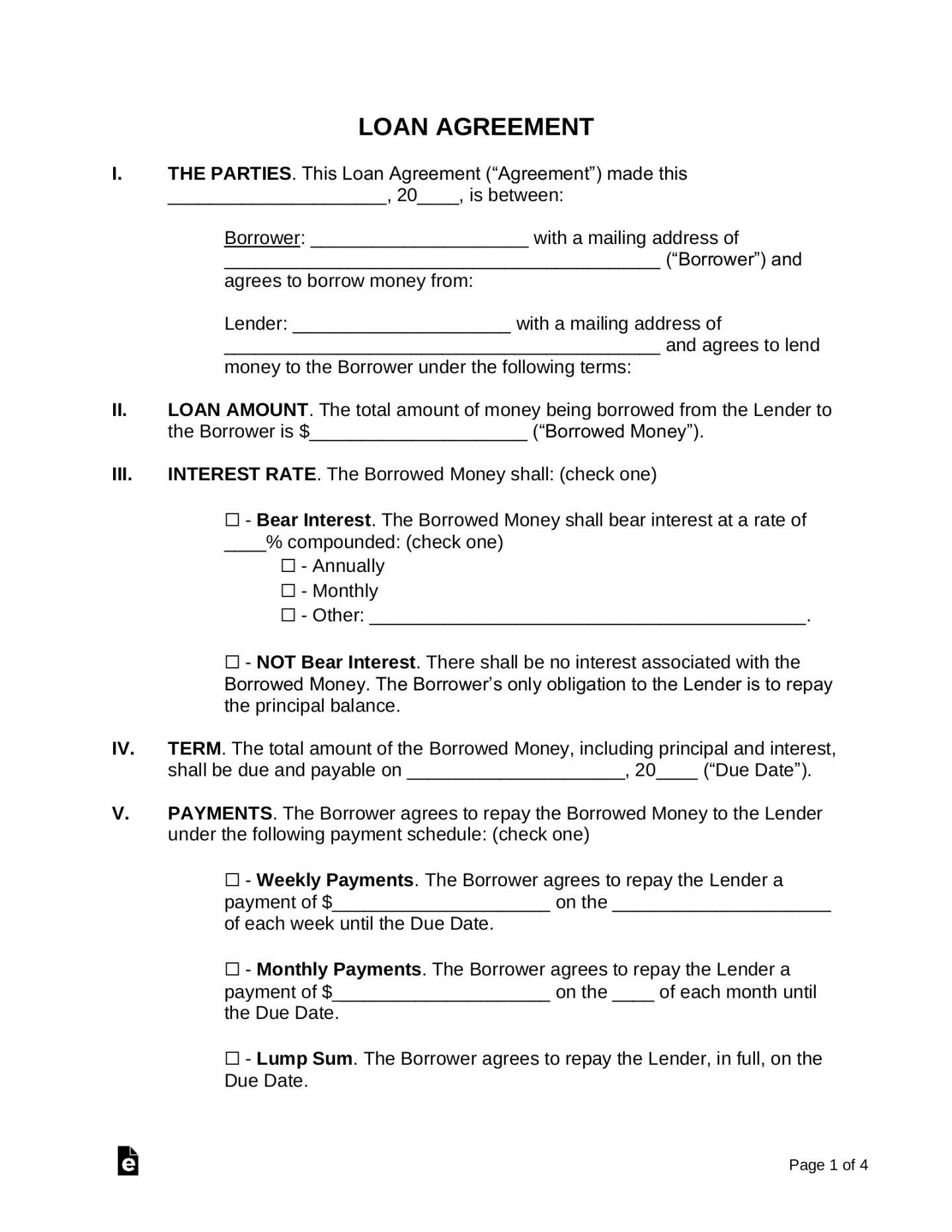

1. Loan Amount and Terms: Clearly state the total loan amount, the interest rate, and the repayment schedule. This information should be presented in a concise and easily understandable format.

2. Borrower and Lender Information: Include the full names and contact details of both the borrower and the lender. This information is crucial for establishing the legal relationship between the parties.

3. Loan Purpose: Specify the intended use of the loan funds. This information helps to ensure that the loan is used for legitimate purposes.

4. Repayment Schedule: Outline the specific dates and amounts of each installment payment. This information should be presented in a clear and organized manner.

5. Default Provisions: Address the consequences of a missed or late payment, including potential penalties or fees. These provisions should be fair and reasonable.

6. Prepayment Clause: Specify the conditions under which the borrower can repay the loan in full before the scheduled maturity date. This clause should protect the interests of both parties.

7. Governing Law: Indicate the jurisdiction that will govern the loan agreement. This information is important for resolving any disputes that may arise.

8. Signatures: Ensure that both the borrower and the lender sign the agreement to make it legally binding.

Design Elements for Professionalism and Trust

1. Clarity and Conciseness: Use simple language and avoid technical jargon. The agreement should be easy to read and understand for all parties involved.

2. Consistent Formatting: Maintain a consistent format throughout the document, using headings, subheadings, and bullet points to improve readability.

3. Professional Layout: Choose a clean and professional layout that enhances the overall appearance of the agreement. Avoid cluttered designs that can be difficult to navigate.

4. High-Quality Fonts: Select fonts that are easy to read and visually appealing. Avoid using excessive fonts or font styles that can make the document look unprofessional.

5. White Space: Use white space effectively to create a visually balanced and uncluttered document. Avoid cramming too much information into a small space.

6. Branding Elements: If applicable, incorporate your company’s branding elements, such as your logo and color scheme. This can help to establish trust and credibility.

Additional Considerations

Legal Review: It is highly recommended to have the agreement reviewed by a legal professional to ensure that it complies with all applicable laws and regulations.

By carefully considering these elements, you can create a professional free installment loan agreement template that effectively protects the interests of both the borrower and the lender while maintaining a positive and trustworthy relationship.