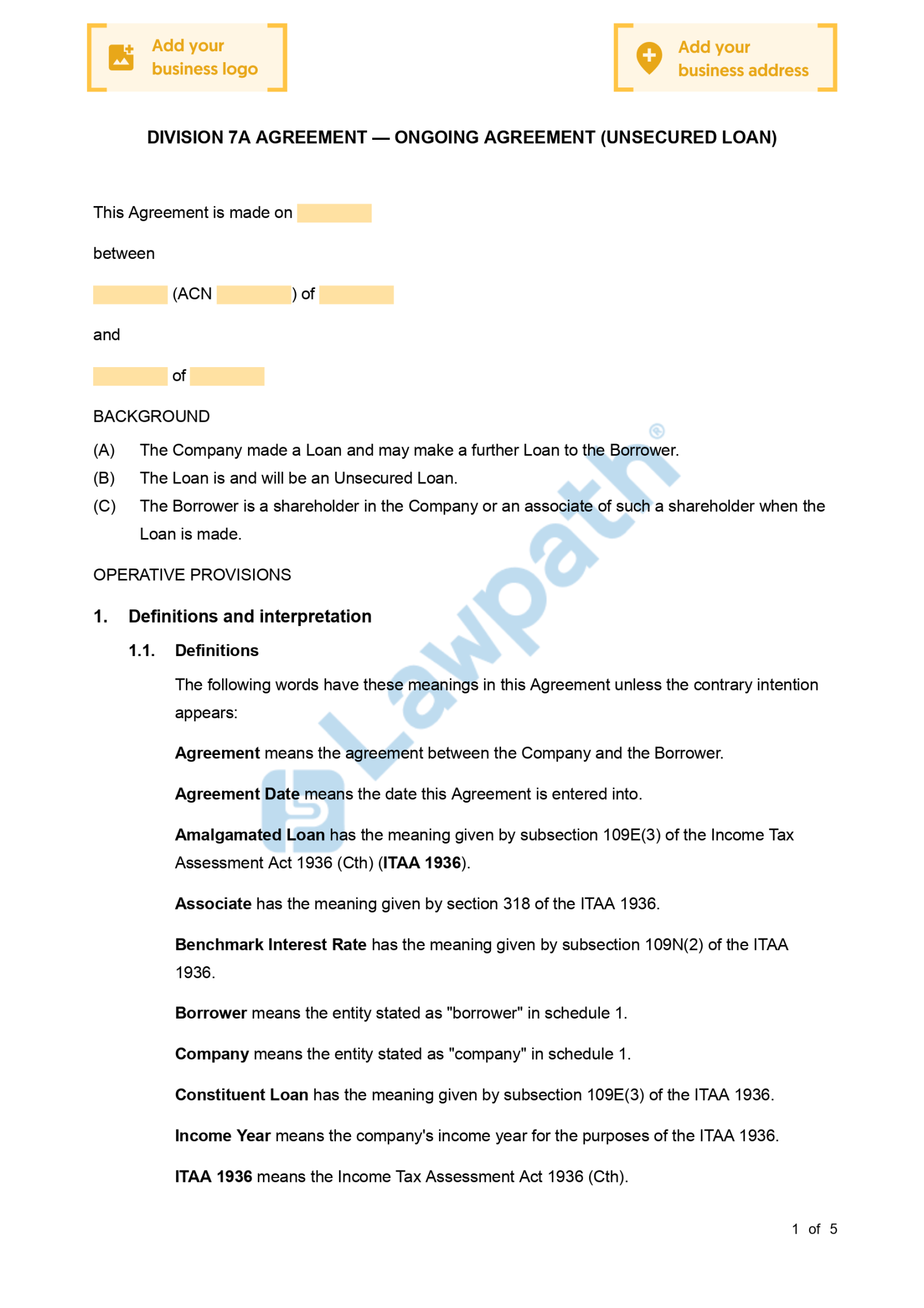

Division 7a Loan Agreement Template Free is a crucial document for businesses seeking Small Business Administration (SBA) financial assistance. This template provides a standardized framework for outlining the terms and conditions of a loan agreement between a lender and a borrower. By utilizing a well-crafted template, businesses can ensure that their loan agreements are legally sound, transparent, and protect the interests of both parties.

Key Elements of a Division 7a Loan Agreement Template Free

A professional Division 7a Loan Agreement Template Free should incorporate the following essential elements:

Loan Amount and Repayment Schedule

Loan Amount: Clearly state the total amount of the loan being granted.

Collateral

Collateral Description: If applicable, provide a detailed description of the collateral securing the loan. This may include real estate, equipment, or other assets.

Default and Remedies

Default Events: Clearly define events that constitute a default under the loan agreement, such as late payments, non-compliance with covenants, or bankruptcy.

Covenants

Financial Covenants: Establish financial ratios or performance metrics that the borrower must maintain throughout the loan term.

Prepayment and Assignment

Prepayment: Specify whether the borrower has the right to prepay the loan and, if so, under what conditions.

Governing Law and Dispute Resolution

Governing Law: Indicate the jurisdiction whose laws will govern the loan agreement.

Designing a Professional Template

To create a Division 7a Loan Agreement Template Free that conveys professionalism and trust, consider the following design elements:

Clarity and Conciseness: Use clear and concise language to avoid confusion and ensure that both parties understand their obligations.

Additional Considerations

Consult with Legal Counsel: It is highly recommended to consult with an attorney experienced in SBA lending to ensure that the template complies with applicable laws and regulations.

By carefully crafting a Division 7a Loan Agreement Template Free that incorporates the essential elements and design principles outlined above, businesses can establish a solid legal foundation for their SBA loans and protect their financial interests.