Essential Elements of a Debt Agreement Template

A debt agreement template is a formal document that outlines the terms and conditions of a loan or debt repayment arrangement between two parties. To create a professional and effective template, it is essential to include the following elements:

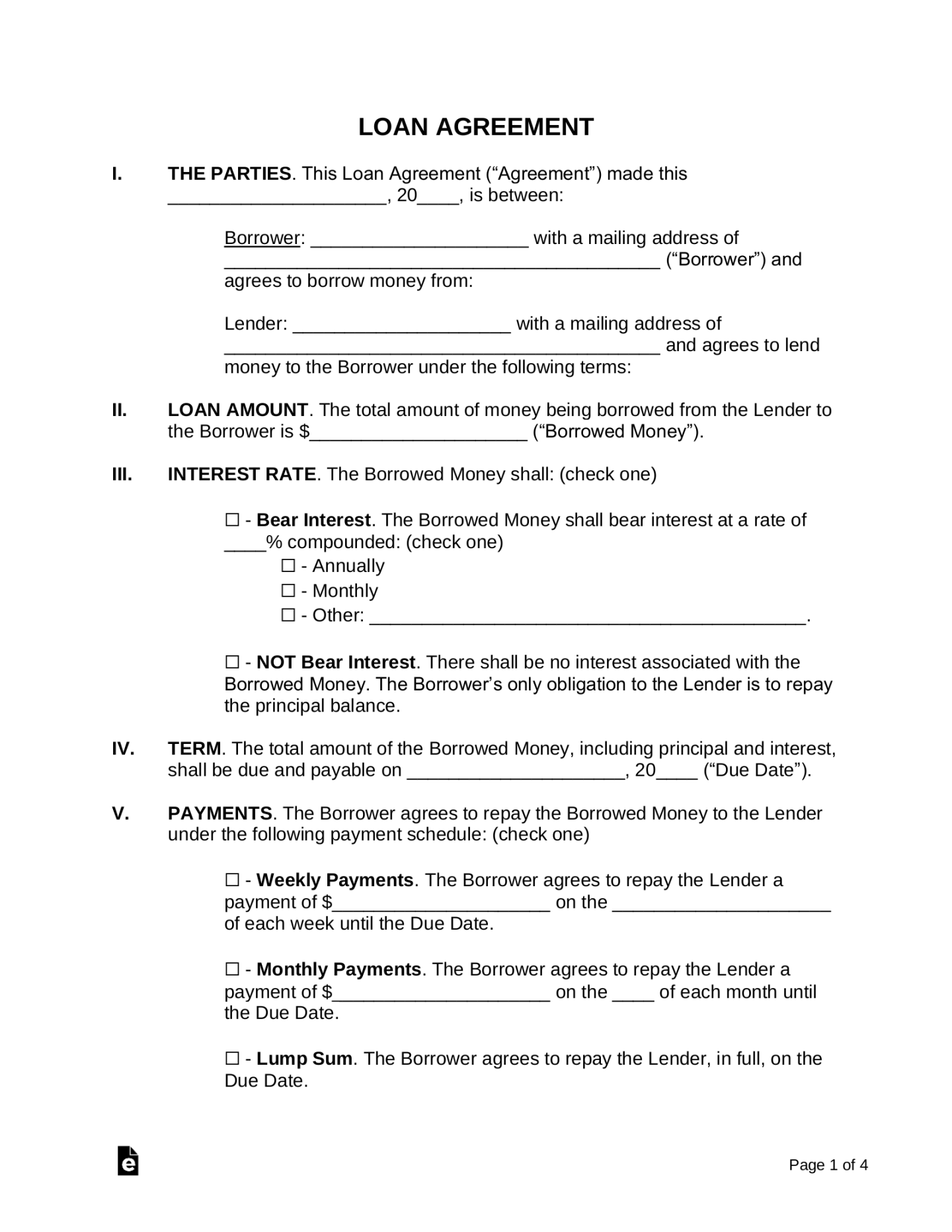

1. Identification of Parties: Clearly state the names and contact information of both parties involved in the agreement. This information should be placed prominently at the top of the document.

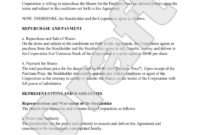

2. Recitals: This section provides a brief overview of the circumstances leading to the agreement. It can include statements such as the nature of the debt, the reason for the agreement, and any relevant background information.

3. Definitions: Define any technical terms or acronyms that may be used in the agreement to ensure clarity and understanding. This is particularly important if the document involves legal or financial concepts.

4. Debt Amount and Repayment Schedule: Specify the total amount of the debt, the interest rate (if applicable), and the repayment schedule. This should include the frequency of payments, the due dates, and any penalties for late payments.

5. Security Interest (if applicable): If the agreement involves collateral or security, clearly outline the terms of the security interest. This may include a description of the collateral, the rights of the lender, and the procedures for enforcing the security interest.

6. Default and Remedies: Define what constitutes a default under the agreement and specify the remedies available to the lender in case of a default. This may include acceleration of the debt, foreclosure on collateral, or legal action.

7. Dispute Resolution: Include a clause specifying the method for resolving disputes that may arise between the parties. This could involve arbitration, mediation, or litigation.

8. Governing Law and Jurisdiction: Indicate the governing law that will apply to the agreement and the jurisdiction in which any legal proceedings will be held.

9. Entire Agreement: A clause stating that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous agreements or representations.

10. Notices: Specify how notices or communications should be given between the parties, including the address and method of delivery.

11. Signatures: Provide space for both parties to sign the agreement, along with their printed names and dates.

Design Elements for Professionalism and Trust

To convey professionalism and trust, it is essential to consider the following design elements when creating your debt agreement template:

By carefully considering these elements, you can create a debt agreement template that is both professional and effective. A well-designed template will help to establish trust between the parties and ensure that the terms of the agreement are clearly understood.