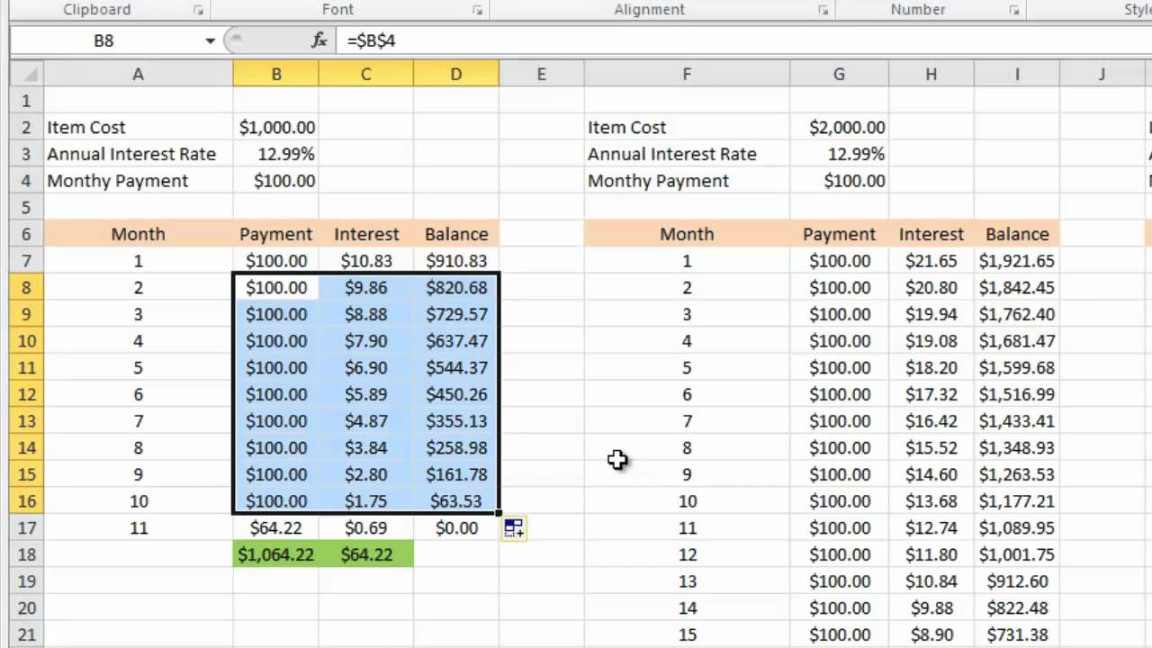

A Credit Card Interest Calculator Excel Template is a valuable tool for anyone looking to better understand the financial implications of their credit card usage. By accurately calculating interest charges, individuals can make informed decisions about their spending habits and debt management strategies. This guide will provide you with the essential steps and design considerations for creating a professional and effective Excel template that meets your specific needs.

1. Define the Purpose and Scope of Your Template:

Before embarking on the design process, it is crucial to clearly define the purpose and scope of your Credit Card Interest Calculator Excel Template. Consider the following questions:

Target Audience: Who will be using the template? Are you creating it for personal use or for a broader audience?

2. Design the User Interface:

The user interface of your Credit Card Interest Calculator Excel Template should be intuitive and easy to navigate. Here are some key design elements to consider:

Layout: Organize the template in a logical and visually appealing manner. Use clear headings and labels to guide users through the input and output sections.

3. Develop the Calculation Formulas:

The core functionality of your Credit Card Interest Calculator Excel Template lies in its calculation formulas. These formulas will determine the interest charges, minimum payments, and other financial metrics based on the input data. Ensure that the formulas are accurate and reflect the specific interest calculation methods used by credit card companies.

4. Incorporate Visual Aids:

Visual aids can enhance the understanding and engagement of your Credit Card Interest Calculator Excel Template. Consider using the following elements:

Charts: Create charts to visualize the growth of credit card debt over time or the impact of different interest rates on monthly payments.

5. Test and Refine:

Once you have completed the design and development of your Credit Card Interest Calculator Excel Template, it is essential to thoroughly test it to ensure its accuracy and functionality. Input various data sets and compare the calculated results to verify their correctness. Make necessary adjustments to refine the template and address any issues that may arise.

6. Consider Additional Features:

Depending on your specific needs, you may want to consider incorporating additional features into your Credit Card Interest Calculator Excel Template. Some possibilities include:

Debt Reduction Strategies: Provide information or calculations related to different debt reduction strategies, such as the debt snowball or debt avalanche methods.

By following these guidelines and incorporating the recommended design elements, you can create a professional and effective Credit Card Interest Calculator Excel Template that empowers individuals to make informed financial decisions.