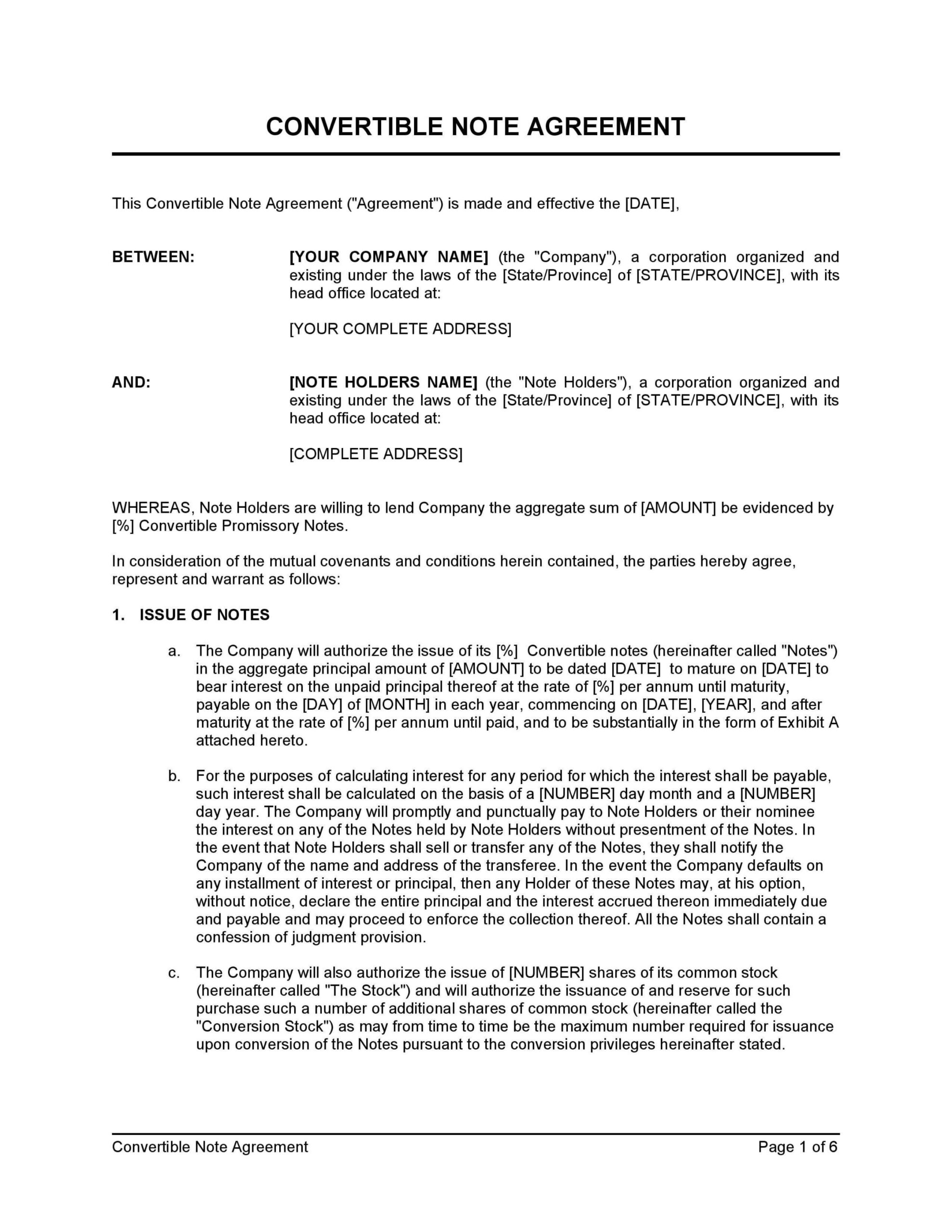

Key Components of a Convertible Loan Agreement

A convertible loan agreement is a legal document that outlines the terms and conditions of a loan that can be converted into equity, typically common stock, under certain circumstances. This type of loan is often used by startups and early-stage companies to raise capital without giving up too much ownership upfront.

Here are the essential components of a convertible loan agreement:

1. Loan Amount and Interest Rate

Loan Amount: The total amount of money being loaned to the company.

2. Conversion Terms

Conversion Price: The price per share at which the loan will be converted into equity.

3. Maturity Date and Repayment

Maturity Date: The date on which the loan is due to be repaid in full if it has not been converted into equity.

4. Security and Guarantees

Security: Any collateral or assets that the borrower is pledging to secure the loan.

5. Warranties and Representations

Warranties: Statements made by the borrower about the company’s financial condition, operations, and legal status.

6. Events of Default

Default Events: The events or conditions that would trigger a default on the loan, such as non-payment of interest or principal, breach of covenants, or insolvency.

7. Governing Law and Dispute Resolution

Governing Law: The jurisdiction that will govern the interpretation and enforcement of the agreement.

Design Elements for a Professional Convertible Loan Agreement

To create a professional and trustworthy convertible loan agreement, consider the following design elements:

Clear and Concise Language: Use plain language that is easy to understand, avoiding legal jargon whenever possible.

Conclusion

A well-crafted convertible loan agreement is essential for protecting the interests of both the lender and the borrower. By understanding the key components of the agreement and incorporating professional design elements, you can create a document that is both legally sound and visually appealing.