Understanding the Purpose of a Church Tax Donation receipt Template

A Church Tax Donation Receipt Template is a formal document that serves as proof of a charitable contribution made to a religious organization. It is essential for donors to retain these receipts for tax purposes, as they can often claim deductions based on their donations. A well-designed template not only fulfills this legal requirement but also reinforces the credibility and trustworthiness of the church.

Key Design Elements for a Professional Template

When designing a Church Tax Donation Receipt Template, it is crucial to incorporate elements that convey professionalism and inspire confidence in donors. Here are some essential design considerations:

# 1. Clear and Consistent Branding

Logo Placement: Ensure the church’s logo is prominently displayed in a consistent location on all receipts.

# 2. Essential Information

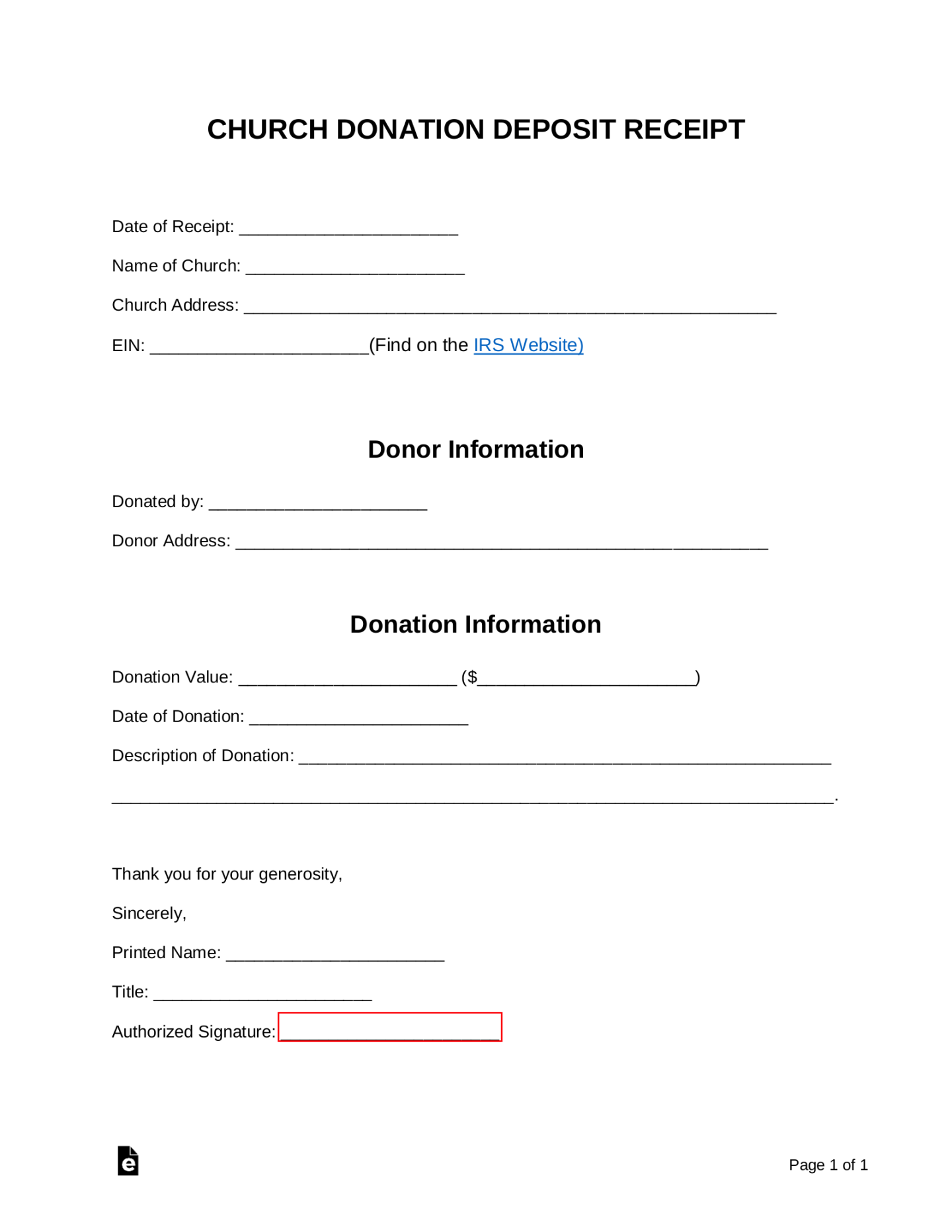

Donor Information: Include the donor’s name, address, and contact details.

# 3. Receipt Number and Date

Unique Identifier: Assign a unique receipt number to each donation for tracking and reference purposes.

# 4. Church Information

Church Name: Include the full legal name of the church.

# 5. Signature and Authorization

Authorized Signature: Obtain a signature from an authorized representative of the church to validate the receipt.

# 6. Layout and Formatting

Clean and Organized Layout: Use a layout that is easy to read and visually appealing.

# 7. Security Features

Watermark: Consider adding a watermark or other security features to prevent fraud and counterfeiting.

Additional Considerations

Accessibility: Ensure the template is accessible to individuals with disabilities by following accessibility guidelines.

By carefully considering these design elements, you can create a Church Tax Donation Receipt Template that is both professional and effective in fulfilling its purpose. A well-designed template can enhance the donor experience, strengthen the church’s reputation, and contribute to overall financial success.

![[Real & Fake] Hotel Receipt Templates ᐅ TemplateLab](https://ashfordhousewicklow.com/wp-content/uploads/2024/09/real-amp-fake-hotel-receipt-templates-templatelab_0-200x135.jpg)