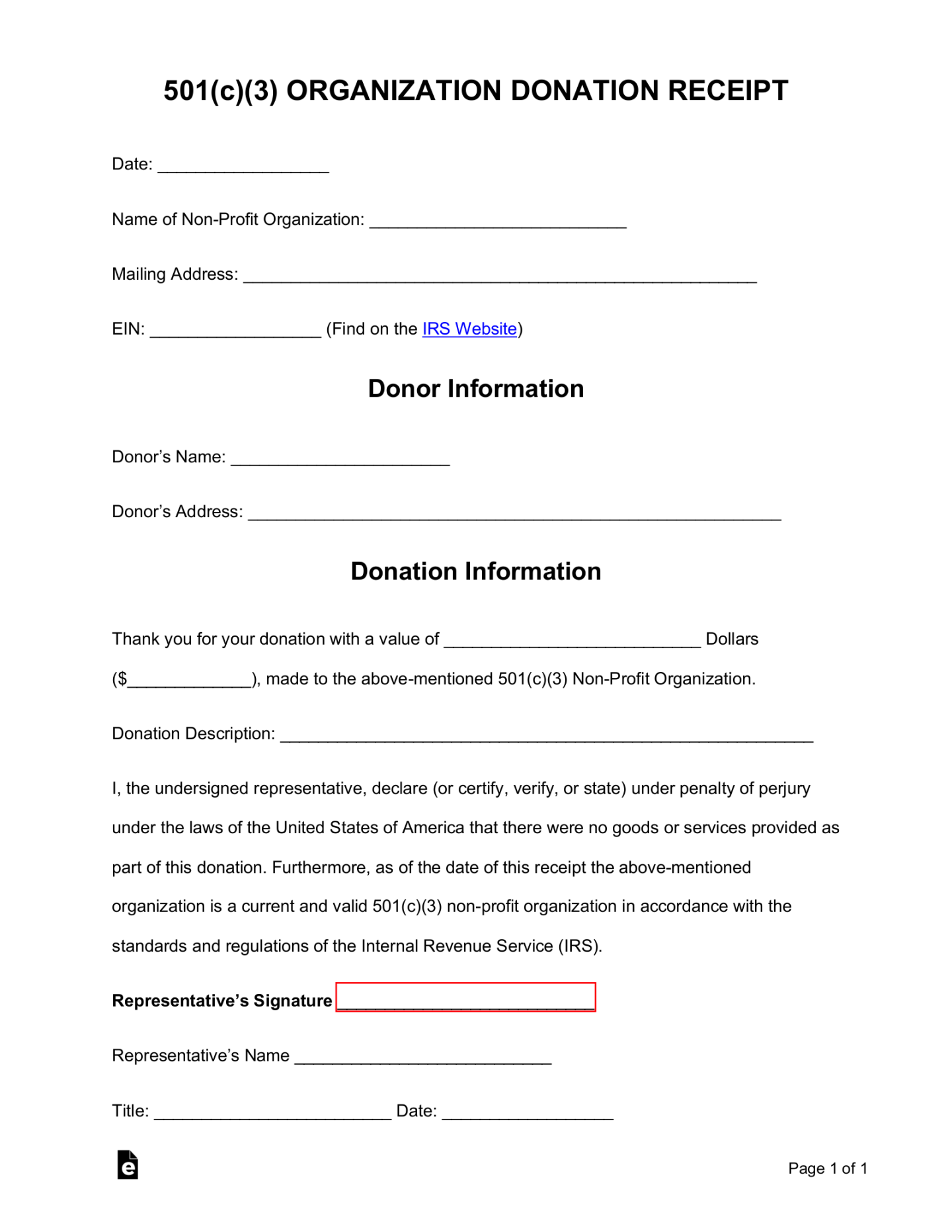

A Charitable Contribution receipt Template is a vital document for non-profit organizations. It serves as a formal acknowledgment of a donor’s financial contribution, providing essential information for tax purposes and fostering trust between the organization and the donor. This guide will delve into the key elements of a professional Charitable Contribution Receipt Template, ensuring that your organization presents a polished and credible image.

Essential Elements

1. Organization Information: Clearly display the organization’s name, address, and contact information. This ensures easy identification and verification.

2. Donor Information: Include the donor’s full name, address, and contact details. This information is crucial for accurate record-keeping and future communication.

3. Donation Details: Specify the date of the donation, the amount contributed, and the method of payment (e.g., cash, check, credit Card). This provides a clear and concise record of the transaction.

4. Donation Purpose: If applicable, indicate the specific purpose or project for which the donation was intended. This helps donors understand how their contribution is being used.

5. Tax Deductibility: Clearly state whether the donation is tax-deductible. If so, provide information about the IRS publication number that supports this claim. This helps donors maximize their tax benefits.

6. Acknowledgment Statement: Include a formal acknowledgment statement, such as “This receipt is provided as a confirmation of your charitable contribution.” This reinforces the official nature of the document.

Design Considerations

1. Professional Layout: Opt for a clean and uncluttered layout that is easy to read and understand. Use consistent fonts, spacing, and margins to create a cohesive and professional appearance.

2. Organization Logo: Include the organization’s logo prominently at the top of the template. This helps reinforce brand identity and instill confidence in donors.

3. Clear and Concise Language: Use clear and concise language throughout the template, avoiding jargon or technical terms that may be unfamiliar to donors.

4. Consistent Branding: Ensure that the receipt template aligns with your organization’s overall branding guidelines, using consistent colors, fonts, and imagery.

5. Security Features: Consider incorporating security features, such as watermarks or unique identifiers, to protect against fraud and unauthorized reproduction.

Additional Considerations

1. Electronic Delivery: Offer electronic delivery options, such as email or online portals, to streamline the process and reduce paper waste.

2. Accessibility: Design the template to be accessible to individuals with disabilities, ensuring compliance with accessibility standards.

3. Legal Review: Consult with legal counsel to ensure that the receipt template complies with all relevant laws and regulations.

By carefully considering these elements and design considerations, you can create a Charitable Contribution Receipt Template that effectively acknowledges donor generosity, promotes trust, and complies with legal requirements. A well-designed receipt serves as a valuable tool for your organization, demonstrating professionalism and transparency.

![[Real & Fake] Hotel Receipt Templates ᐅ TemplateLab](https://ashfordhousewicklow.com/wp-content/uploads/2024/09/real-amp-fake-hotel-receipt-templates-templatelab_0-200x135.jpg)