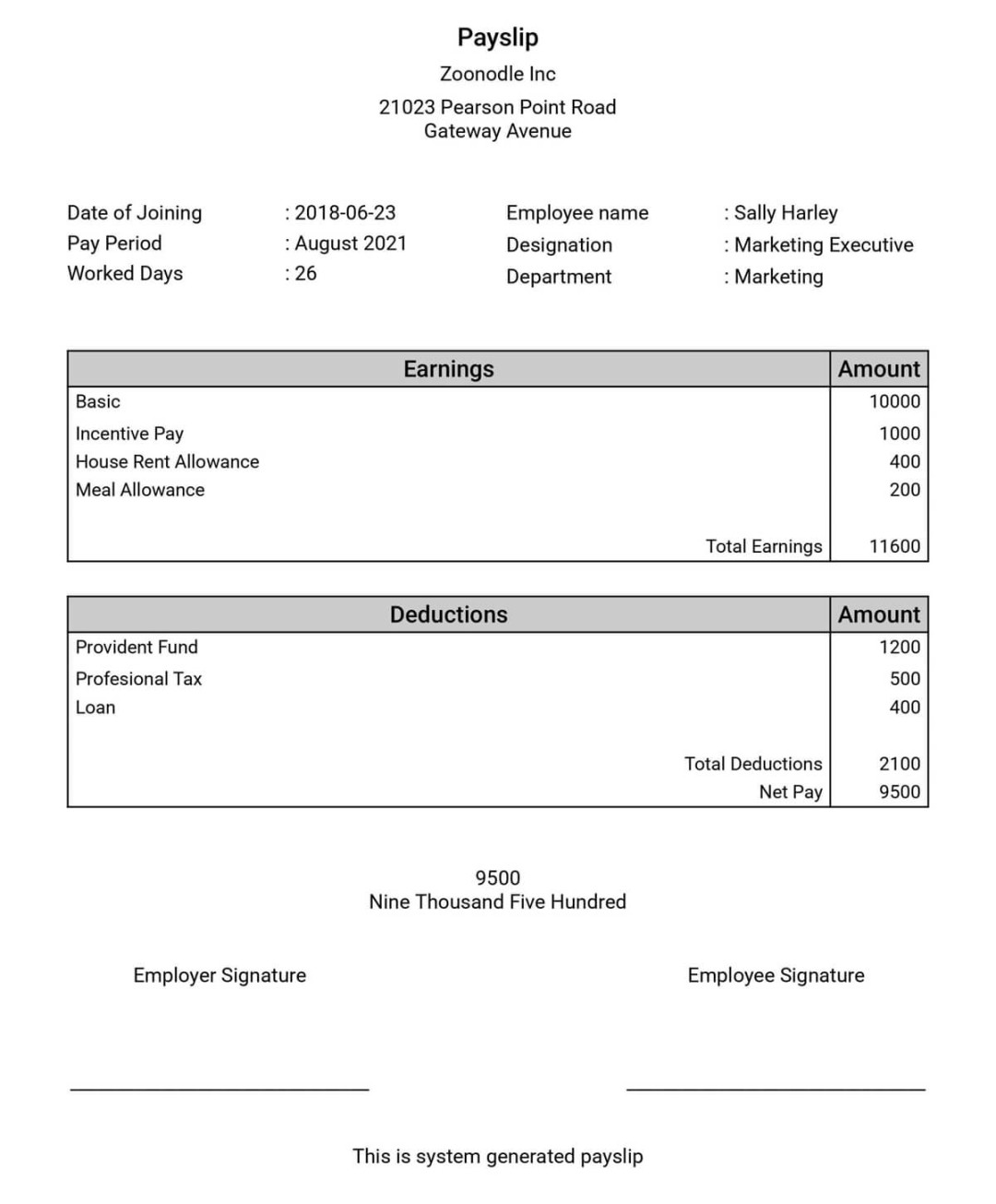

A blank payslip template serves as a foundational document for generating payslips, which are crucial for employees to understand and verify their earnings and deductions. A well-designed template not only ensures accuracy but also conveys professionalism and trust. This guide will delve into the essential design elements and considerations for creating a professional blank payslip template.

1. Essential Information

The core purpose of a payslip is to provide a clear and concise overview of an employee’s earnings and deductions. Therefore, the template must include the following essential information:

Employee Details:

2. Layout and Structure

A well-structured template enhances readability and comprehension. Consider the following layout principles:

Clear Sections: Organize the information into distinct sections (e.g., Employee Details, Earnings, Deductions, Net Pay) to improve clarity.

3. Typography and Fonts

The choice of fonts significantly impacts the overall appearance and professionalism of the template. Consider the following guidelines:

Legibility: Select fonts that are easy to read, especially in smaller font sizes. Avoid overly decorative or script fonts.

4. Colors and Branding

Colors can evoke emotions and reinforce a company’s brand identity. Consider the following points:

Brand Consistency: Incorporate your company’s brand colors into the template to maintain consistency and recognition.

5. Table Design

Tables are often used to present earnings and deductions in a structured format. Consider the following guidelines:

Simplicity: Keep table designs simple and avoid excessive ornamentation.

6. Security and Confidentiality

Protecting employee data is paramount. Consider the following security measures:

Data Encryption: Implement encryption to safeguard sensitive information.

7. Accessibility

Ensure that the template is accessible to employees with disabilities. Consider the following guidelines:

Screen Reader Compatibility: Use appropriate HTML tags and attributes to make the template compatible with screen readers.

By carefully considering these design elements, you can create a professional blank payslip template that effectively communicates employee earnings and deductions while maintaining a positive impression of your organization.