A promise to pay agreement is a legal document that outlines the terms and conditions under which a debtor agrees to repay a debt to a creditor. It is a crucial tool for both parties involved, as it provides a clear and concise record of the financial arrangement. This guide will delve into the essential components of a professional promise to pay agreement template and offer insights into its design elements that convey professionalism and trust.

Essential Components of a Promise to Pay Agreement

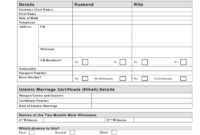

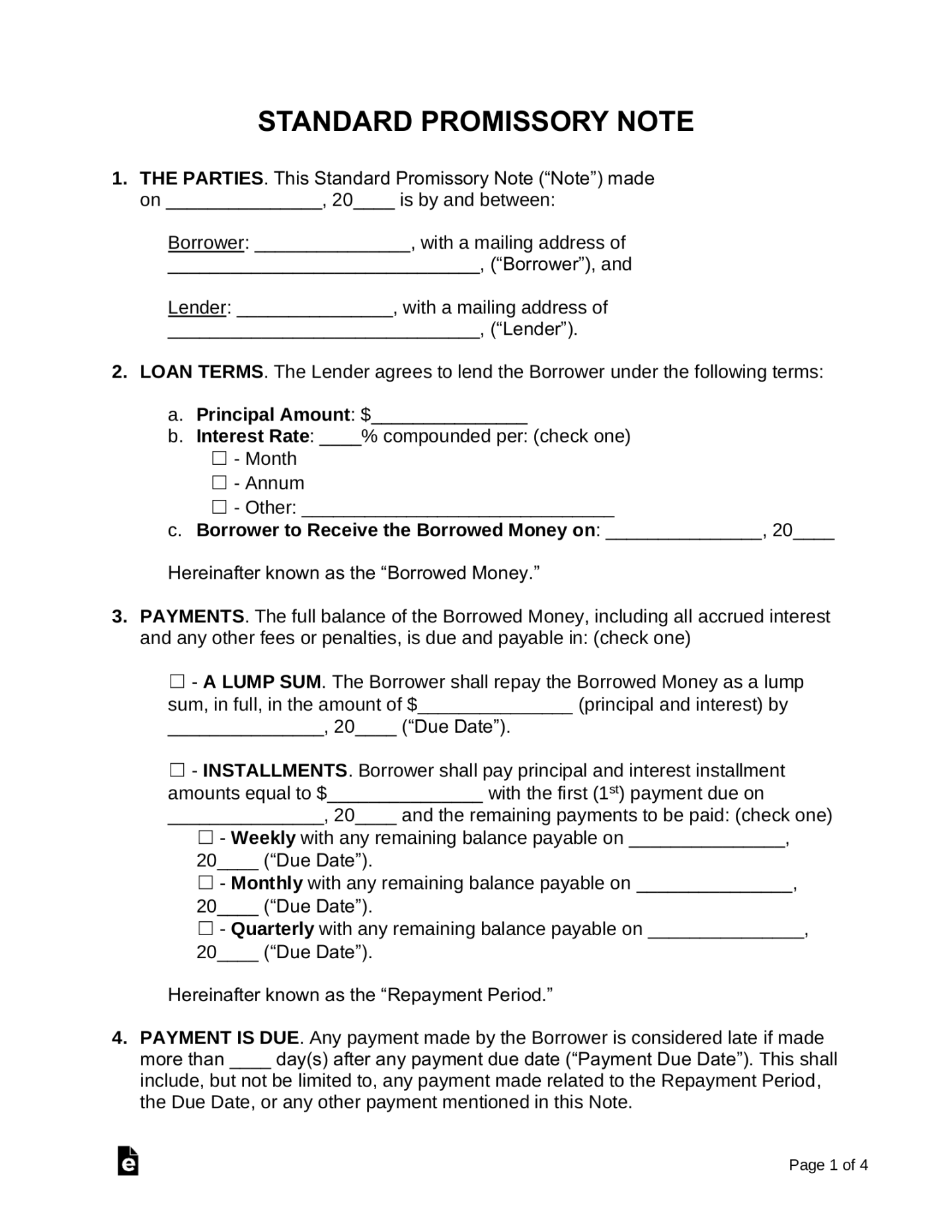

1. Parties Involved: Clearly identify the debtor and creditor. Include their full legal names, addresses, and contact information.

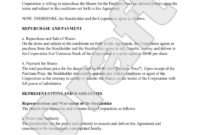

2. Debt Amount: Specify the exact amount of the debt, including any accrued interest or penalties.

3. Payment Schedule: Outline the agreed-upon payment plan, including the frequency of payments, due dates, and the amount of each payment.

4. Payment Terms: Specify the method of payment (e.g., check, wire transfer, online payment) and any applicable fees or charges.

5. Late Payment Penalties: Clearly state the consequences of late payments, such as additional fees or interest charges.

6. Default Provisions: Define what constitutes a default, such as failure to make timely payments or breach of other agreement terms.

7. Dispute Resolution: Outline the process for resolving any disputes that may arise between the parties. This may include mediation, arbitration, or litigation.

8. Governing Law: Specify the jurisdiction that will govern the agreement.

9. Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous agreements.

10. Signatures: Ensure that both the debtor and creditor sign the agreement, along with their printed names and dates.

Design Elements for Professionalism and Trust

1. Clarity and Conciseness: Use clear and concise language that is easy to understand. Avoid legal jargon that may confuse the parties.

2. Professional Layout: Choose a clean and professional layout that is easy to read and visually appealing. Use consistent fonts, spacing, and margins.

3. Heading and Subheadings: Use headings and subheadings to organize the agreement and make it easier to navigate.

4. White Space: Incorporate white space to improve readability and create a more visually appealing document.

5. Alignment: Align the text consistently (e.g., left-aligned) to enhance readability and create a professional look.

6. Font Choice: Select a professional and easy-to-read font, such as Arial, Times New Roman, or Calibri. Avoid using overly decorative or difficult-to-read fonts.

7. Page Numbering: Include page numbers to make it easier to reference specific sections of the agreement.

8. Date: Clearly indicate the date the agreement was signed.

Conclusion

A well-designed promise to pay agreement is a valuable legal tool for both debtors and creditors. By following the essential components and design elements outlined in this guide, you can create a professional and legally sound document that protects the interests of all parties involved.