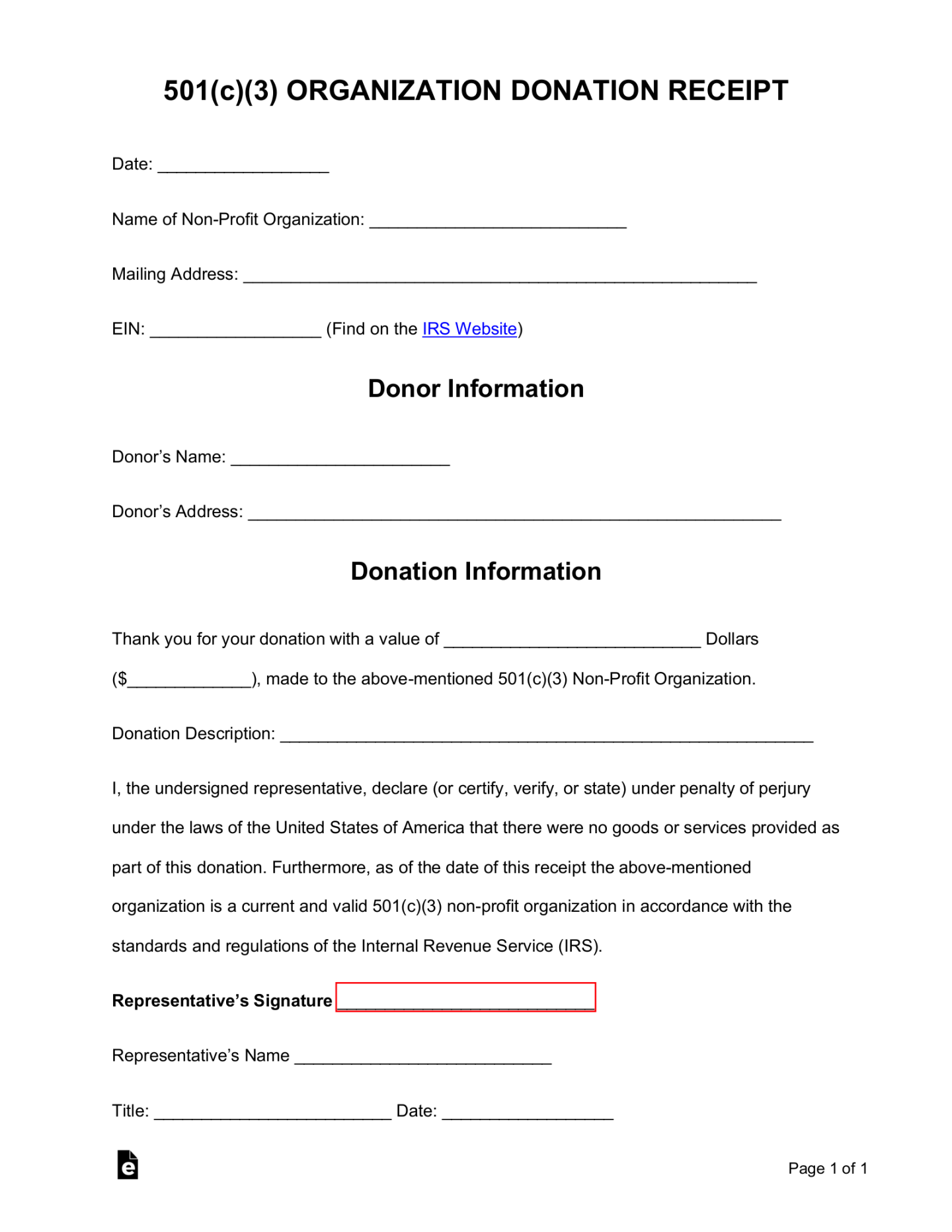

A tax-deductible receipt is a crucial document that allows individuals and businesses to claim tax deductions for eligible expenses. A well-designed template can enhance the professionalism of your organization and streamline the deduction process for your clients.

Essential Elements of a Tax Deductible Receipt Template

To create a professional and effective tax-deductible receipt template, incorporate the following essential elements:

1. Header

Organization Name: Clearly display your organization’s name at the top of the receipt.

2. Recipient Information

Recipient Name: Fill in the full name of the individual or business receiving the receipt.

3. Transaction Details

Description of Goods or Services: Clearly describe the specific goods or services provided. Use concise and accurate language.

4. Payment Information

Payment Method: Specify the method of payment used (e.g., cash, check, credit Card).

5. Tax Information

Tax Rate: Indicate the applicable tax rate for the transaction.

6. Additional Information

Terms and Conditions: If necessary, include any relevant terms and conditions related to the transaction.

Design Considerations for a Professional Tax Deductible Receipt Template

To create a visually appealing and professional receipt template, consider the following design elements:

1. Layout and Formatting

Clear and Consistent Layout: Use a clean and organized layout that is easy to read and navigate.

2. Branding and Color Scheme

Corporate Branding: Incorporate your organization’s branding elements, such as your logo and color scheme, to create a cohesive and recognizable receipt.

3. Legibility and Readability

Font Size: Use a font size that is easy to read, especially for older recipients.

4. Security Features

Watermark: Consider adding a subtle watermark to the background to deter fraud.

5. Accessibility

By carefully considering these design elements, you can create a tax-deductible receipt template that is both professional and functional. A well-designed template will not only enhance your organization’s reputation but also simplify the deduction process for your clients.

![[Real & Fake] Hotel Receipt Templates ᐅ TemplateLab](https://ashfordhousewicklow.com/wp-content/uploads/2024/09/real-amp-fake-hotel-receipt-templates-templatelab_0-200x135.jpg)