A well-crafted legal debt collection letter template is essential for effectively communicating with debtors and recovering outstanding debts. The design and content of the template should convey professionalism, trust, and a clear understanding of the situation. This guide will provide you with the necessary information to create a template that meets these criteria.

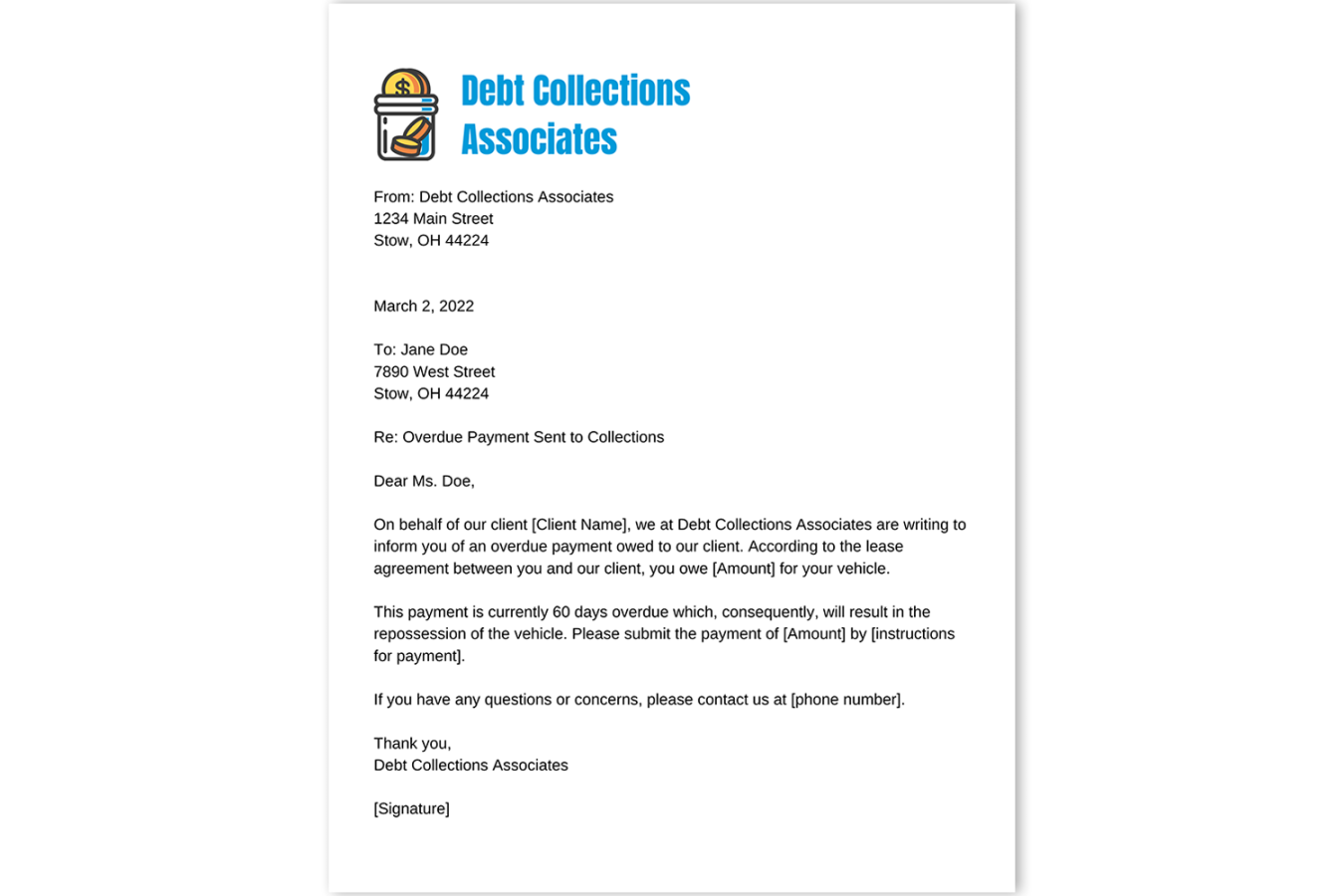

Design Elements

1. Letterhead: The letterhead should prominently display your firm’s name, address, phone number, email address, and website. Consider using a professional logo to enhance your brand identity.

2. Date: The date should be clearly visible and formatted in a professional manner.

3. Recipient’s Address: Ensure the recipient’s address is accurate and complete.

4. Salutation: Use a formal salutation, such as “Dear [Debtor’s Name],” or “Dear Sir or Madam.”

5. Body: The body of the letter should be single-spaced and easy to read. Use clear and concise language, avoiding legal jargon that may confuse the debtor.

6. Closing: A formal closing, such as “Sincerely” or “Yours faithfully,” should be followed by your name and title.

7. Enclosures: If any documents are enclosed with the letter, list them clearly.

Content Elements

1. Reference Number: Clearly state the reference number or account number associated with the debt.

2. Amount Due: Specify the exact amount owed, including any accrued interest or fees.

3. Previous Attempts: Briefly mention any previous attempts to collect the debt, such as phone calls or letters.

4. Payment Terms: Outline the payment terms, including the due date and any acceptable payment methods.

5. Consequences of Non-Payment: Clearly state the potential consequences of non-payment, such as legal action or referral to a collection agency.

6. Contact Information: Provide your contact information, including your phone number and email address, so the debtor can reach out if they have any questions or concerns.

7. Call to Action: Encourage the debtor to contact you to discuss payment arrangements or resolve the debt.

Sample Template

[Your Firm’s Name]

[Your Firm’s Address]

[Your Firm’s Phone Number]

[Your Firm’s Email Address]

[Your Firm’s Website]

[Date]

[Debtor’s Name]

[Debtor’s Address]

Dear [Debtor’s Name],

This letter is a formal notification regarding an outstanding debt in the amount of [Amount Due]. The reference number for this debt is [Reference Number].

We have made several attempts to contact you regarding this outstanding balance. As of [Date], the total amount due is [Amount Due], which includes [Accrued Interest or Fees].

We understand that financial difficulties can arise, and we are willing to work with you to resolve this matter. Please contact us at [Your Phone Number] or [Your Email Address] to discuss payment arrangements or to address any concerns you may have.

If payment is not received by [Due Date], we may be forced to take further legal action.

Sincerely,

[Your Name]

[Your Title]

[Your Firm]

Additional Considerations

Customization: Tailor the template to fit your specific needs and the nature of the debt.

By following these guidelines and carefully crafting your legal debt collection letter template, you can increase your chances of recovering outstanding debts while maintaining a professional image.