Understanding the Credit Purchase Agreement

A credit purchase agreement is a legally binding contract that outlines the terms and conditions governing a credit transaction between a lender and a borrower. It serves as a formal document that protects the interests of both parties involved.

Key Elements of a Credit Purchase Agreement

A well-structured credit purchase agreement should include the following essential elements:

Parties Involved

Lender: The entity providing the credit.

Credit Amount and Terms

Principal Amount: The total sum of money borrowed.

Collateral (if applicable)

Description of Collateral: A detailed account of the assets pledged as security.

Default Provisions

Events of Default: Circumstances that trigger a breach of the agreement.

Governing Law and Jurisdiction

Applicable Law: The legal framework governing the agreement.

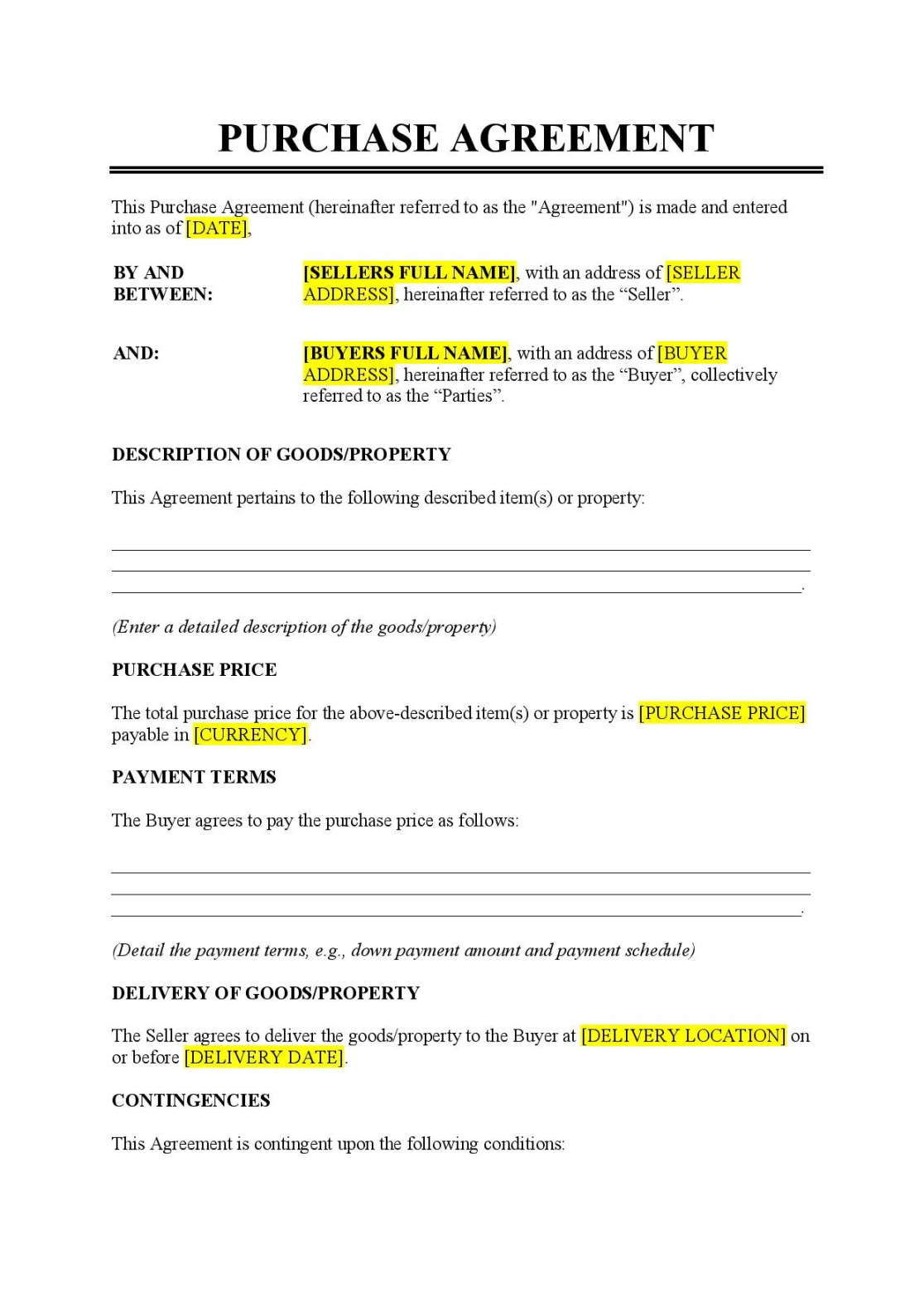

Design Elements for a Professional Credit Purchase Agreement

To create a credit purchase agreement that conveys professionalism and trust, consider the following design elements:

Clear and Concise Language

Avoid Legal Jargon: Use plain language that is easy to understand.

Consistent Formatting

Font and Size: Choose a professional font (e.g., Times New Roman, Arial) and a legible font size.

Headings and Subheadings

Hierarchy: Use headings and subheadings to create a clear structure.

Numbering and Bullet Points

Clarity: Use numbering and bullet points to list items or steps.

White Space

Readability: Use white space to improve readability and visual appeal.

Additional Considerations

Signatures: Obtain signatures from both parties to make the agreement legally binding.

Conclusion

A well-designed credit purchase agreement is essential for protecting the interests of both the lender and the borrower. By incorporating the key elements and design principles outlined in this guide, you can create a professional and legally sound document that fosters trust and transparency in your credit transactions.