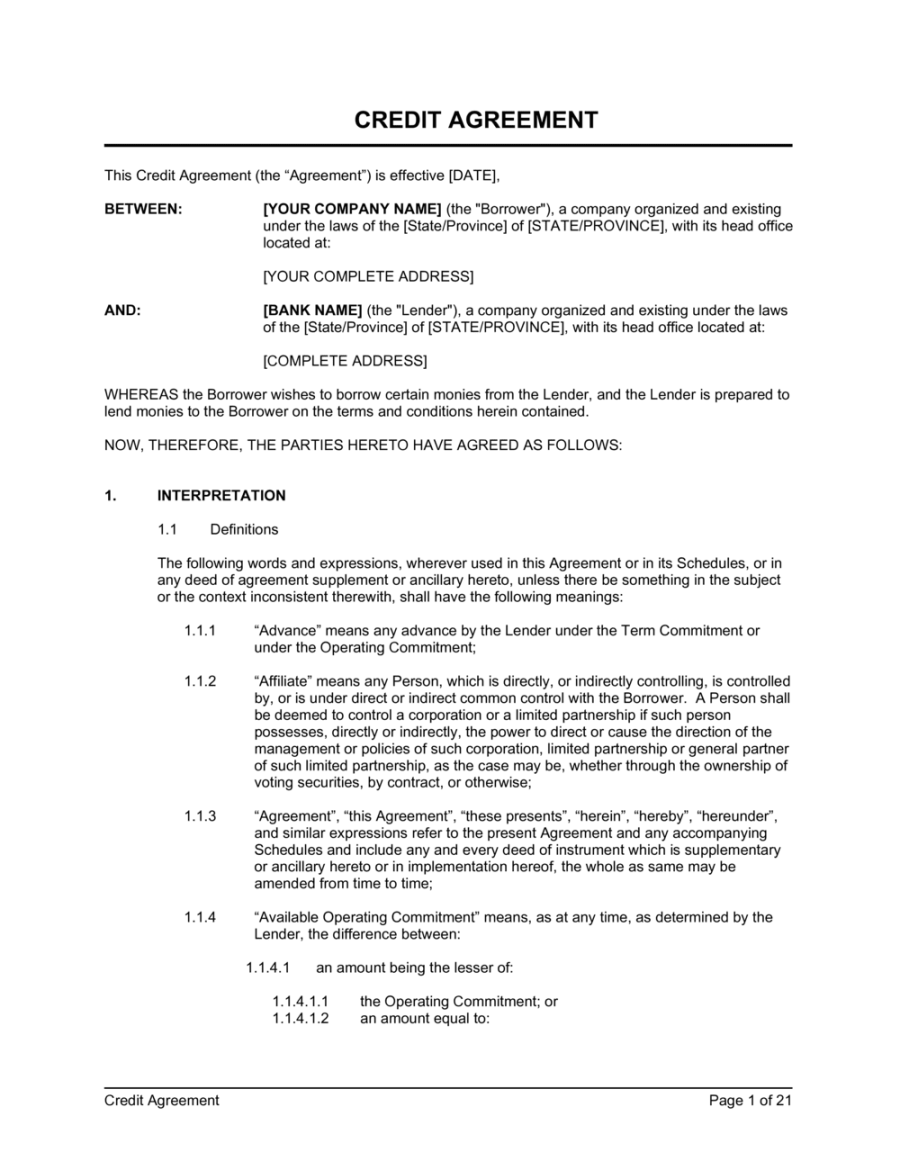

Understanding the Credit Terms Agreement Template

A credit terms agreement template is a legal document that outlines the conditions under which a seller extends credit to a buyer. It serves as a contract between the two parties, defining the terms of payment, interest rates, late fees, and other relevant provisions.

Key Components of a Credit Terms Agreement Template

1. Parties Involved: Clearly identify the seller and buyer, including their legal names and addresses.

2. Credit Limit: Specify the maximum amount of credit that the seller is willing to extend to the buyer.

3. Payment Terms: Detail the due date for payments, the acceptable payment methods (e.g., check, credit Card, wire transfer), and any discount terms for early payment.

4. Interest Rates: Define the interest rate that will be charged on any outstanding balance, including the calculation method (e.g., simple interest, compound interest).

5. Late Fees: Specify the late fees that will be charged if payments are not made on time, including the calculation method and any maximum penalties.

6. Security: If applicable, outline any security measures that the seller requires, such as a personal guarantee or collateral.

7. Dispute Resolution: Describe the process for resolving disputes between the seller and buyer, including mediation or arbitration procedures.

8. Governing Law: Indicate the jurisdiction that will govern the agreement, ensuring that any legal disputes are handled under the appropriate laws.

9. Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

10. Signatures: Include a section for both parties to sign the agreement, indicating their acceptance of the terms and conditions.

Design Elements for a Professional Credit Terms Agreement Template

1. Layout and Formatting: Use a clean and consistent layout with clear headings and subheadings. Employ professional fonts that are easy to read, such as Arial or Times New Roman. Ensure proper alignment and spacing to enhance readability.

2. Branding: Incorporate your company’s branding elements, such as your logo, colors, and fonts, to create a cohesive and professional appearance.

3. Clarity and Conciseness: Use simple and direct language that is easy to understand. Avoid legal jargon or overly complex terminology.

4. Organization: Structure the agreement in a logical order, with clear sections and subsections. Use bullet points or numbered lists to present information concisely.

5. Professional Appearance: Print the agreement on high-quality paper and use a professional binder or folder to present it.

Additional Considerations

Legal Review: Consult with an attorney to ensure that the agreement complies with all applicable laws and regulations.

By following these guidelines and incorporating the key components of a credit terms agreement template, you can create a professional and legally sound document that protects your business interests and establishes clear expectations with your customers.