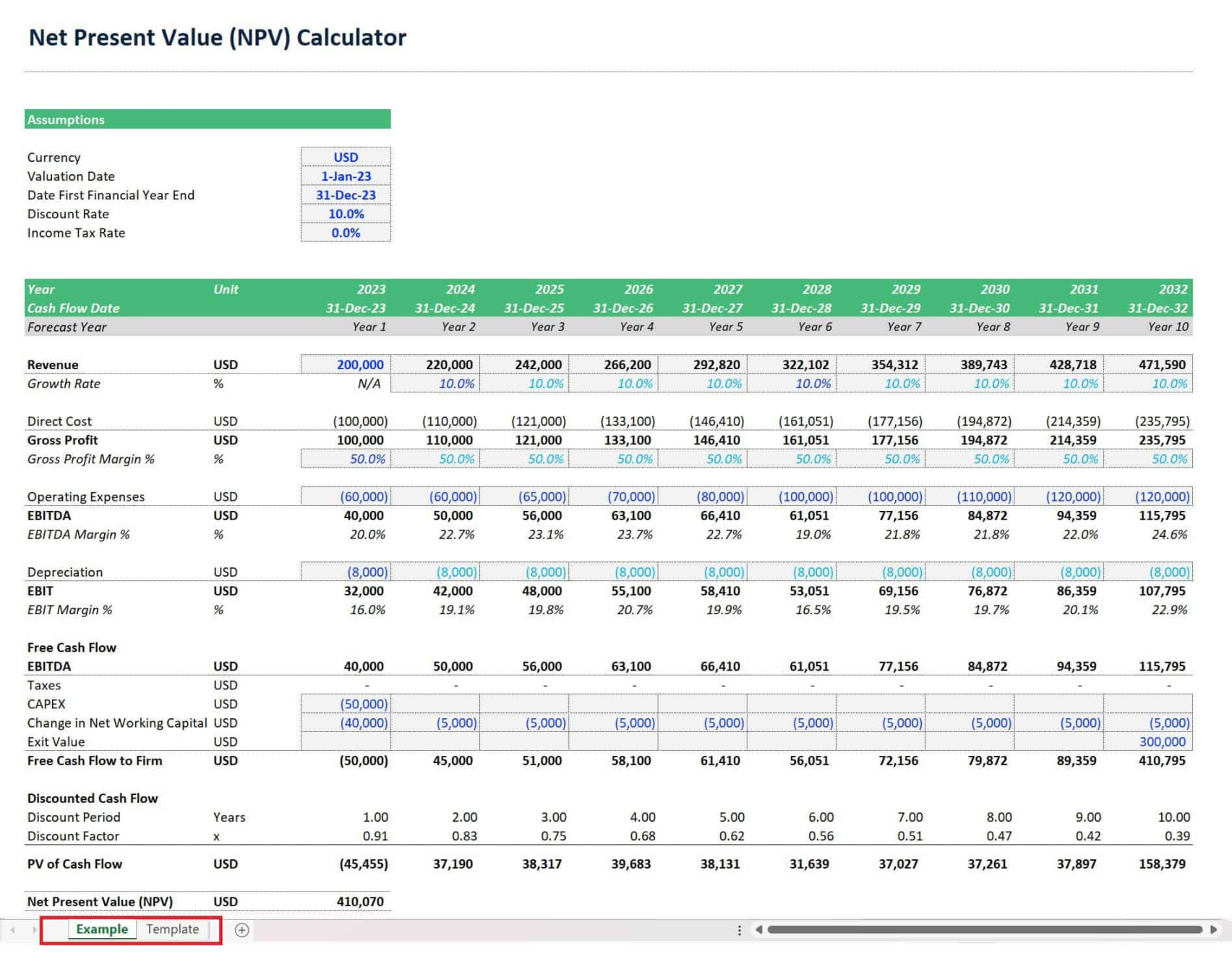

Understanding Net Present Value (NPV)

Net Present Value (NPV) is a financial metric that calculates the present value of future cash flows, discounted at a specific rate. It is a crucial tool for businesses to evaluate the profitability of potential investments. By comparing the NPV to zero, businesses can determine whether an investment is expected to generate a return that exceeds the cost of capital.

Designing a Professional NPV Excel Template

A well-designed NPV Excel template can significantly enhance the efficiency and accuracy of financial analysis. Here are the key elements to consider when creating a professional template:

1. Clear and Concise Layout:

Consistent Formatting: Use a consistent font, font size, and style throughout the template. This creates a visually appealing and professional look.

2. Input Data Section:

Required Fields: Include all the essential data fields for calculating NPV, such as initial investment, cash flows, discount rate, and project duration.

3. Calculation Section:

NPV Formula: Use the NPV function in Excel to calculate the present value of future cash flows. Ensure that the formula is accurate and references the correct input cells.

4. Output Section:

NPV Result: Clearly display the calculated NPV value, along with any other relevant financial metrics.

5. Formatting and Styling:

Professional Themes: Use a professional Excel theme to enhance the overall appearance of the template.

6. User-Friendliness:

Comments and Instructions: Add comments or instructions within the template to guide users and explain the purpose of different sections.

7. Security and Protection:

Password Protection: Consider protecting the template with a password to prevent unauthorized access or modifications.

8. Documentation:

By following these guidelines, you can create a professional Net Present Value Excel template that is both visually appealing and functionally effective. A well-designed template can help businesses make informed investment decisions and improve their financial performance.